How to Create an Investor Presentation [Templates + Tips]

![How to Create an Investor Presentation [Templates + Tips]](https://visme.co/blog/wp-content/uploads/2021/11/How-to-Create-an-Investor-Presentation-Header.jpg)

When you’re about to raise capital for your startup, having a great investor presentation can grab the attention of VCs and angel investors.

Potential investors often look for information like the problem you’re trying to solve, the business model, the financials and how you plan to spend the money you’re raising.

To make sure your pitch is just right, we’ve shared proven ways to create an investor presentation along with customizable templates to get you started. This article is for founders who are actively looking for fundings and reaching out to investors.

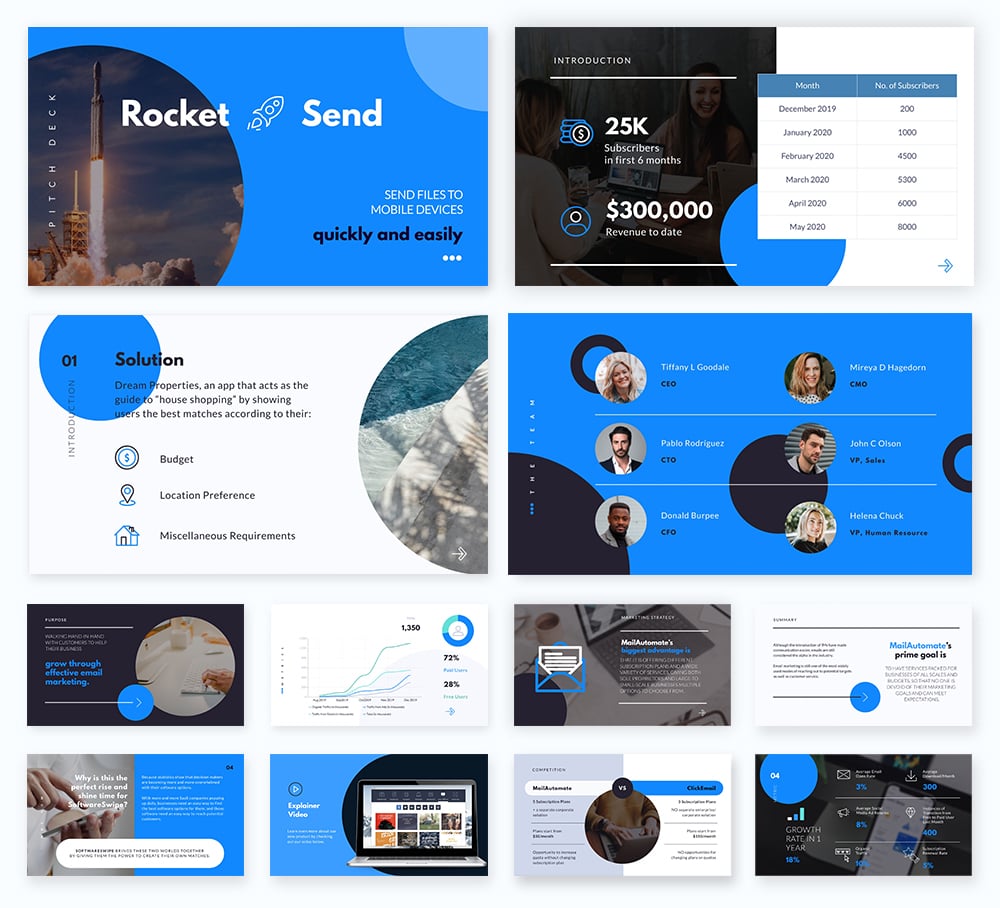

Here's a short selection of 8 easy-to-edit investor presentation slides you can edit, share and download with Visme. View more below:

Before diving in, let’s take a quick look at what an investor presentation really is.

Ready to create an investor presentation? Use our startup pitch deck theme with 70+ pre-made slides and put together a stunning investor presentation in minutes. It's fast, easy and works in your browser!

What is an Investor Presentation?

An investor presentation provides a clear, concise yet informative overview of your business to potential investors. It covers key points of your business such as your vision, market opportunity, products and services, high-level financials and funding needs.

A winning pitch deck needs to be both short and complete at the same time. Investors only spend an average of 3 minutes and 44 seconds on a pitch deck. This means you need to strive for quality, not quantity in your investor presentation.

Hey executives!

Looking to cut design costs?

- Spend less time on presentations and more time strategizing

- Ensure your brand looks and feels visually consistent across all your organization's documents

- Impress clients and stakeholders with boardroom ready presentations

Investor Presentation Theme [Edit and Download]

The beginning of your investor presentation can make or break the opportunity. Within the first four slides, potential investors begin to evaluate your business idea and determine whether you’re someone they want to invest in or do business with long-term.

In the next section, you'll learn how to put together an investor presentation that helps you make it to the next meeting and secure the funds you need to grow your business.

How to Create the Perfect Investor Presentation

Investors come across several investor presentations every single day. The challenge is to make your pitch deck stand out and hook them right off the bat. You want to strike the right balance between the psychological, business and financial aspects of your presentation.

If you know how to provide a narrative, you can easily create a stellar pitch deck that can communicate your proposal effectively. Here are eight tips that will help.

1. Build a Compelling Story to Hook Investors

It’s important to create a cohesive story that grabs the attention of the investors right off the bat. It’s an opportunity to show how you came up with that idea and why you’re so passionate about it.

The best pitch decks start with a real problem. For instance, you might be working as a customer success rep and recognize a lack of data visibility that you can improve with a simple solution. By sharing why you decided to launch your startup, you can create a powerful narrative.

While there’s no one-size-fits-all when it comes to the “art of storytelling” in investor presentations, there are a few ways you can make sure that you have a compelling story:

- Be concise. Investors make their decisions in just under a few minutes of your presentation. You need to create a crisp and effective story that communicates your idea clearly. Make sure you have a visually appealing presentation design for your pitch deck - not too cluttered with just the right amount of information.

- Differentiate. Start out by showing why you are different, gaps in the existing market, and how your solution is more poised for success than any competitors. Quantify wherever possible. Emphasize the financial upside of your idea.

- Validate your solution. Provide real-life examples of the problem and use-cases of your solution. Share how many people are struggling with the same challenges, give evidence that your solution works. Client reviews, testimonials, data, case studies, and customer success stories can make investors more inclined and confident.

2. Discuss Target Market and Opportunity

Use this slide to cover your solution’s market potential. Answer questions like:

- What is the need for your product or service?

- What is the total market size?

- How do you plan to transform this into a business opportunity?

- What are the financial outcomes you expect?

Investors will want to know specifics like how many buyers exist and how much money they are willing to spend on your solution. If you’re serving various verticals or industries, divide your market into segments and explain them using different types of your product offerings.

Now, this slide is a bit tricky because every entrepreneur likes to boast about the size of the problem they’re dealing with. Overinflated market size and blanket statements leave the impression that you have not fully understood your market and cause ambiguity.

Instead of saying, “eCommerce is a trillion-dollar industry,” try saying, “We’re aiming to offer our services to a niche-eCommerce vertical which is currently a million-dollar industry, but expected to grow at a compound annual growth rate (CAGR) of 25.3%.”

Instead of saying, “Hospitality is a billion-dollar industry.” Try saying, “Our solution is specifically built for luxury properties with a market size valued at USD 93.37 billion.”

If you want to learn how to give a good presentation, especially when it comes to a pitch desk, lead with solid metrics that reflect you’ve put a good deal of thought into understanding the opportunity.

3. Highlight Your USP and Value Proposition

Investors are trying to find exceptional businesses and you might even have one, but the key is to communicate the value of your startup. Describe the technology behind it, the frameworks you use or the secret sauce behind your solution. When you share this, you are cutting through the noise and establishing the USP of your startup.

You may want to talk about the existing solutions in the market, but avoid spending too much time on competitors. Instead, transition to what makes you better.

One of the most powerful ways to convey your value proposition is by framing use-cases based on real-life scenarios. This is generally where founders like to put up numbers on the presentation slides to engage investors — and the latter love to see the quantifiable value!

This number is usually related to time or cost (or both) that potential buyers can save with your solution. Here are a couple of ways to say this:

- We can reduce manual efforts by X times in the IT industry.

- We can enhance sales metrics for logistics companies by X times.

- We can offer rich data visibility to distributed teams at an affordable price.

- We offer X times more speed than Y solution.

Short, direct statements like this are a great way to provide specifics to the investors. The idea is to use less text and more schematics, diagrams, and flowcharts in your presentation structure. If you have a prototype or demo, this is where you use them in your investor presentation.

4. Showcase Who Needs Your Product and Why

Explaining exactly who needs your product is critical to your investor presentation. It’s much easier to gloss over buyers based on industry trends such as “a product manager in the SaaS industry uses X product or service.” But these findings only reveal the top-level information and are quite far away from what actually happens in real-life sales.

One of the best presentation tips is to share the roadmap for your product adoption. A great way of doing this is by wrapping your stats in a story. So, rather than just presenting stats or saying you can save X amount of monetary value or time for your buyers, explain the behavior or preferences you are overcoming with your solution. This supports your value proposition and immediately grabs the attention of your audience.

Describe their day-to-day wants and needs. Create a journey to show the frustrations of your customers and what your stats mean in practice for them. The goal is to convey the essence of what your solution can achieve.

If you already have early adopters or sales, mention customer success stories and talk about the challenges they have overcome. If you’re still in the ideation or development phase, talk about your strengths or a unique angle that’s going to give you an edge over your competitors.

It can be helpful to bring out features of your product or service at this point in your investor presentation. For instance, if your biggest competitor offers features like complex automations for lengthy workflows, make it a case and talk about how smaller companies would prefer using an easy-to-use software that offers decent automation for shorter workflows.

Remember, your investor presentation is not about pretending you know it all and your competitors are doing everything wrong. You want to fill in the gaps, or cater to a niche audience, or address specific pain points. Unless you’re actually solving a trillion-dollar problem. Then you will have to prove that business case to your investors.

5. Prove You Are the Right Founder and Team

When you’re a growing startup, you must convince people that your vision is the right one and that you have the right team to execute it. Especially when you’re in the early life of your startup where you might not have a lot of “customer success stories” and all you have is people.

Your team slide should feature your founders. While it’s crucial to display a team’s skills and experience, the founding team’s attitude is a big differentiator for investors.

Generally, founders that have first-hand experience with the challenges they’re trying to solve are more passionate about their business idea, challenges they want to overcome, and their target customers are more likely to succeed in the long term.

“Yes, seed investors understand that early-stage companies have many unknowns and the idea will change a lot, so they look carefully at the people to see whether the team will be able to adapt.”

Reid Hoffman, LinkedIn Co-Founder, and Greylock Partner

Think of it like a well-oiled machine - each part has its own function and role that compliments every other part. So, it’s important to put together a team with diverse skills and expertise that is capable of handling different sides of the business.

A good example of a team slide is for the LinkedIn pitch which showed a stunning bench that not only had a substantial entrepreneurial knack and technical expertise but was also experienced in the inception stages of the social networking industry.

6. Current Status, Financials, Timeline and Metrics

Dealing with financial data is a tricky beast of its own. In a CB Insights report about the top 20 reasons startups fail, the second most common reason, behind lack of product-market fit, is “running out of cash.”

When you’re preparing an investor presentation, it’s important to create this slide with just the right amount of details. You shouldn’t dive into in-depth spreadsheets that are too complex to understand. Use visually appealing and concise graphics such as charts to show total customers, sales, expenses and profits.

Walk your audience through your financials such as income statement, sales forecast, and cash flow forecast. You might also want to highlight metrics like customer acquisition cost (CAC).

Explain the current status of your product or service, what future milestones look like, and how you will use the money you’re trying to raise. It can also be persuasive to ask investors for their help and expertise in certain areas as this offers more transparency to them.

7. Finally, Make a Lasting Impression

Now that you’ve collected and structured your investor presentation, it’s time to make a brief, actionable statement that sums up your deck. You may only have 30 minutes with these investors. So, it’s crucial to make a lasting impression that will solve any doubts they may have.

The best pitch decks place traction numbers here or some type of hook to get investors interested. Figures like prototypes ready, existing customers, MRR, ARR, market and predicted growth are great ways to make a last impression.

Another good way of wrapping it up is by providing an executive summary, also called a summary memo, to the investors. Simply put, it’s a two-to-three-page summary of your business that they can share with their partners and other stakeholders to provide an overview of your pitch deck and business.

At the end of it, ask them if they need any additional data or information from your side and set a realistic ETA for when you can deliver them. While sending this information, add the summary of the deck and your investor presentation.

Next Steps For Your Investor Presentation

Creating an investor presentation is intimidating but incredibly important.

There are a lot of things you need to take care of while designing your pitch deck. To make it easier and quicker for you to get started, you can use our pitch deck style presentation theme.

Mix and match slides, customize each and every element, drag and drop built-in graphics or upload your own, add music, interactivity, animation and much more. Create new and custom Dynamic Fields to ensure key information across your project doesn't fall through the cracks.

Sign up for a free account today and create a great investor presentation with all the resources Visme has in store for you.

Create Stunning Content!

Design visual brand experiences for your business whether you are a seasoned designer or a total novice.

Try Visme for free