Due Diligence Reports: A Complete Guide [+ Templates]

![Due Diligence Reports: A Complete Guide [+ Templates]](https://visme.co/blog/wp-content/uploads/2023/10/Due-Diligence-Reports-A-Comprehensive-Guide-with-Actionable-Templates-Header.jpg)

Creating a due diligence report isn't just gathering and analyzing financial data, legal documents, and operational metrics. The report provides a structured summary that assesses business viability, uncovers liabilities, and confirms asset value that investors and decision-makers use to reduce risk and validate transactions.

So, what exactly goes into a due diligence report and how can you create you own?

In this complete guide, we'll cover everything you need to know about creating due diligence reports. We'll provide you with customizable due diligence templates and AI features to streamline the entire process.

Before you jump in, check out this video, where we share the five-step framework to make a due diligence report.

Table of Contents

- What Is a Due Diligence Report?

- The Three (3) Types of Diligence

- What To Include in a Due Diligence Report?

- How To Write a Due Diligence Report

- The Due Diligence Process

- Due Diligence Checklist

- Due Diligence FAQs

Quick Read

- A due diligence report is a document that provides an extensive overview of findings from a detailed investigation.

- Due diligence can be conducted on an individual, business, organization, or investment opportunity.

- There are three main types of due diligence: legal, financial and commercial due diligence.

- A due diligence report should capture these key elements. Executive summary, company overview, purpose, due diligence (financial, legal, operational, commercial, market, environmental and regulatory), insurance and risk management, growth prospects and recommendations.

- The due diligence process involves these key steps: a preliminary assessment, confidentiality agreement, due diligence planning, document reviews, site visits and interviews, analysis, validation and risk assessment, documentation and report preparation, decision-making and negotiation and deal closing.

- Visme offers beautiful due diligence templates and advanced tools to help anyone create effective due diligence reports and other business documents. Use Visme's report maker to put together professional-looking reports in minutes.

What is a Due Diligence Report?

A due diligence report is a comprehensive business document that summarizes the findings of a thorough investigation. These investigations could be about an individual, business, organization, or investment opportunity.

In the report, the analyst highlights what actions were taken, the information uncovered and recommendations for how to proceed.

Due diligence is often carried out before events like investments, partnerships, mergers and acquisitions, business exit and other transactions.

The goal is to assess the overall health of the potential investment or acquisition target.

With this insight, investors can make informed decisions about whether to proceed with a transaction, negotiate terms, adjust the deal structure or walk away from the deal.

Creating due diligence reports also helps investors and businesses to:

- Identify potential risks and liabilities and mitigate them.

- Comply with due diligence requirements, regulatory requirements and industry standards.

- Negotiate better terms and pricing for a transaction.

- Protect businesses and assets from bad deals, fraud, misrepresentation and other forms of exploitation.

- Reduce the risk of future disputes and litigation

- Enhance their reputation and credibility among stakeholders and more.

Here's an example of a due diligence report:

The Three (3) Types of Diligence

There are three primary categories of due diligence: legal, financial and commercial due diligence.

Although each focuses on different areas, they shouldn’t be conducted in isolation.

That’s because the due diligence conducted in one area can shed light on—or even enhance—the audit in other areas. Adopting a holistic approach to due diligence ultimately leads to more thorough and accurate assessments.

Legal Due Diligence

Legal due diligence examines the legal affairs and obligations of a transaction. Conducting due diligence in law helps you identify potential legal issues that could impact the transaction, the target company, or the acquirer.

A legal due diligence report typically includes the following information:

- Company structure and governance. The company's organizational documents, board minutes, shareholder agreements and other governing documents.

- Contracts and agreements. All significant contracts, including client agreements, vendor contracts, employment contracts and partnership agreements.

- Litigation history. Details of ongoing or past litigation, disputes, or regulatory issues.

- Intellectual Property. Patents, trademarks, copyrights, trade secrets and licenses.

- Compliance documents. Certifications, permits, licenses and regulatory compliance records.

- Real estate and land use. Real estate ownership, leases, zoning restrictions and other land-use agreements.

- Data privacy and security. Handling of sensitive information, data breach protocols and compliance with applicable data protection laws.

- Physical security. Assessment of on-site security measures, access control systems, and protocols for protecting physical assets and personnel.

- Taxation. An examination of the company's tax returns, financial statements and other tax-related documents to identify potential tax liabilities, deductions and credits.

- Environmental and safety regulations. Review of the company's environmental and safety policies and procedures.

Here’s an example of due diligence report you can customize

Financial Due Diligence

Financial due diligence aims to examine the financial health and viability of the business.

The main focus is verifying the financial information provided and evaluating the business's performance.

Here are the key components typically involved in financial due diligence:

- Financial statements. Balance sheets, income and cash flow statements for several years.

- Financial ratios. Liquidity ratios, profitability ratios, leverage ratios, etc., to assess the company's financial health.

- Tax records. Tax returns, compliance status and outstanding tax liabilities.

- Revenue and cost analysis. Breakdown of revenue sources and major cost components.

- Audit reports. If applicable, include reports from external auditors.

- Capital expenditures. Overview of past and planned capital expenditures.

Here's another example of a financial due diligence report you can use.

Commercial Due Diligence

Commercial due diligence primarily evaluates the market and commercial aspects of the business or investment opportunity. It helps investors, private equity firms and companies assess the commercial and market viability of the target company.

Below are the key components of the commercial due diligence report.

- Market analysis. Market size, growth trends and competitive landscape analysis.

- Customer analysis. Customer segmentation, customer satisfaction data and customer retention rates.

- Sales and marketing strategies. Overview of sales channels, marketing strategies and customer acquisition cost analysis.

- Product and service analysis. Product/service portfolio, differentiation and innovation.

- Growth and expansion opportunities. Strategies for entering new markets and opportunities for expanding the product or service.

Here's a commercial due diligence report example to help you cr

What To Include in a Due Diligence Report?

As we’ve mentioned, there are different types of due diligence reports. The details of your report vary depending on the type of due diligence and purpose.

Here is a detailed breakdown of what to include in a general due diligence report format.

1. Executive Summary

If you're looking for how to make a due diligence report, begin with an executive summary.

This section provides a high-level overview of the main findings, including any major red flags or areas of concern.

Remember to keep your due diligence executive summary concise and easy to understand for readers who may not have the time or expertise to delve into the full report.

2. Company Overview

Provide a brief description of the company, including its history, mission statement, products or services offered, target markets and any notable achievements or milestones.

3. Purpose of Due Diligence

Clearly state why the company's due diligence is being conducted and the report's objectives. Is it for a merger and acquisition deal, partnership, investment opportunity, etc.?

4. Financial Due Diligence

Present a detailed analysis of the company's financial performance, including income statements, balance sheets, cash flow statements and other relevant financial metrics.

Discuss any trends, patterns, or anomalies observed in the financial data and provide insights into the company's financial health and stability. Provide information on tax returns, compliance status and outstanding tax liabilities.

Share a breakdown of revenue sources and major cost components, including past and planned capital expenditures. If applicable, include reports from external auditors.

Incorporate data visualizations to organize and visualize figures. Visme has 50+ customizable charts, graphs, maps and widgets to help you present complex data in a simple format.

And if you have data from external sources, Visme has you covered. You can import data from Google Sheets, MS Excel, Google Analytics, and SurveyMonkey into your chart. Watch this video to see how it works.

5. Legal Due Diligence

Investigate the company's compliance with relevant laws and regulations, including environmental, labor and tax laws. Identify potential legal risks or liabilities and discuss measures the company can take to mitigate them.

6. Operational Due Diligence

Assess the efficiency and effectiveness of the company's operations, including its production processes, supply chain management, logistics and distribution networks.

Share information about the company’s organizational structure, key management personnel and employee demographics. Evaluate the company's management practices, such as employee training programs, performance monitoring and succession planning.

Provide an overview of the company’s IT infrastructure, including technology systems, software applications and cybersecurity measures. Share insights into key customer relationships, supplier agreements and customer concentration analysis.

7. Market Due Diligence

Evaluate the company's marketing and sales strategies, including product positioning, pricing, advertising and customer acquisition tactics. Discuss the competitive landscape, market trends and potential growth opportunities.

Also, dig deeper into customer segmentation, customer satisfaction data and customer retention rates. This will help you identify opportunities for growth and expansion.

8. Regulatory and Environmental Due Diligence

Evaluate the company's commitment to environmental sustainability and social responsibility. Examine its policies and practices regarding energy consumption, waste management, diversity, equity and inclusion.

9. Insurance and Risk Management

Identify the company's potential operational, financial, reputational and strategic risks. Describe the risk management policies and procedures. Then, provide insurance coverage details, including property, liability and key person insurance.

10. Future Growth Prospects

Assess the company's prospects for future growth and expansion. Identify opportunities for organic growth, partnerships, collaborations, or acquisitions and offer recommendations for maximizing growth potential

11. Conclusion and Recommendations

Summarize the key findings and recommendations from the due diligence process.

Discuss the identified risks and their potential impact on the investment or acquisition. Outline actionable steps the company can take to address identified issues, capitalize on opportunities and achieve long-term success.

12. Appendix

Include relevant documents that support the report's findings. These may include contracts, legal filings, financial models, market research reports, and other relevant data.

Remember, business due diligence reports vary. If you want to create a general due diligence report, we've provided templates below to get you started.

If you need help with creating your next due diligence report, use the AI document generator to create one quickly, complete with content and branding. You can customize the report using our intuitive editor.

How To Write a Due Diligence Report

Let’s show you how you can write a due diligence report that ticks all the right boxes

Step 1: Clearly define the scope of the due diligence process

This first step is where your investigation begins.

What are the questions you need answers to? What are the areas and aspects you want to examine? Financial records, legal documents, operational processes, and potential risks? How will you gather the information you need in the next step?

Answering these questions helps you define a scope that keeps you and your team focused on the most important aspects of the exercise. It also reduces the likelihood that important tasks and actions will slip through the cracks.

Step 2: Gather Relevant Information

Collect all relevant information and documentation related to the business or investment opportunity.

Why’s this important? It gives you in-depth insights into the entity or company you’re investigating

Depending on the type of due diligence report, you can collect data from financial statements, contracts, customer/supplier lists, organizational charts, regulatory compliance records and more.

You’ll find this information in public records, regulatory filings, industry reports and other relevant sources. You may also need to interview the management, employees, suppliers, customers or other stakeholders.

Step 3: Analyze the Gathered Data

The next step is to review the information you’ve gathered. Then perform a thorough analysis to find any patterns or insights that can guide your due diligence process.

You can analyze the company's financial performance, annual operating reports, market position, competitive landscape, legal and regulatory compliance, operational efficiency, and any potential liabilities or risks.

Avoid examining the data from a narrow perspective. Instead, consider multiple viewpoints or angles, identify trends and outliers and consider any potential limitations or biases.

Doing an in-depth analysis will help you:

- Understand the company's overall health and viability

- Identify strengths, weaknesses, opportunities and threats

- Uncover any hidden issues or liabilities, and

- Make an informed decision regarding potential investments or acquisitions

Step 4: Organize the Findings into a Comprehensive Report

Your report should clearly present the findings, analysis, and recommendations in a structured format. Include an executive summary, detailed sections for each aspect of the due diligence, and a conclusion with recommendations.

We’ve already discussed what to include in your due diligence and several templates below to get you started quickly.

But if you need help with creating a report in a fraction of the time, Visme’s AI report writer can do the heavy lifting—all you need is the right text. Just describe what you want to create, choose your design and watch the tool generate a beautiful report—with design and content. You can further customize the report with Visme’s intuitive drag-and-drop editor.

Step 5: Provide Recommendations

Based on the analysis, provide recommendations for the stakeholders involved. This could include spotting any areas of concern, potential opportunities for improvement or risks that need to be addressed.

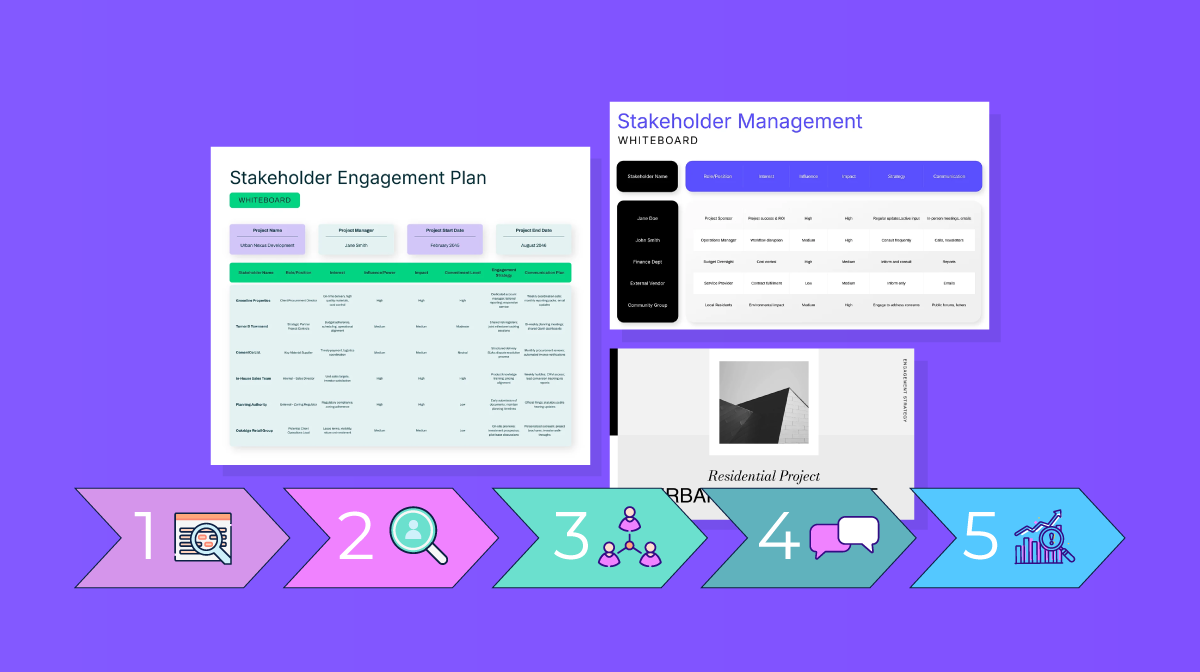

The Due Diligence Process

The due diligence process can be broken down into several distinct steps.

Although the importance of each stage may vary depending on the type of due diligence, these are the key steps that are generally involved in the process.

If you're unsure about how to write a due diligence report, use this process as a starting point.

We’ve also shared due diligence tools and templates to guide you through the process.

1. Preliminary Assessment

This step is also called initial due diligence. Before launching a full-scale due diligence process, the investor or buyer starts by defining the objectives of the due diligence process. They also spell out what aspects of the target company must be investigated.

The investor will conduct an initial review of the company's publicly available information from sources like

- Website,

- Annual reports,

- Financial statements,

- News articles and more.

This preliminary audit helps buyers assess the company's overall attractiveness and identify potential red flags.

2. Confidentiality Agreement

Before gaining access to sensitive information, the parties involved typically sign a non-disclosure agreement (NDA) to protect the confidentiality of the target company's data. The NDA also covers any other sensitive information shared during the process.

Here’s a customizable template you can use to draft your non-disclosure agreement.

3. Due Diligence Planning

At this stage, the investor assembles the due diligence team. This team of experts may include financial analysts, legal advisors, operational specialists and industry experts who can help evaluate the company's operations, financials and legal status.

The team will then create a due diligence request list (DDRL) outlining the documents and information they need to review.

The checklist may include financial statements, contracts, employee records and intellectual property documents.

4. Document Reviews, Site Visits and Interviews

Once the target company provides the requested documents, the buyer's due diligence team will review them carefully.

Depending on the nature of the business, the buyer may also conduct site visits to inspect the target company's facilities, manufacturing processes and other operations. This allows the buyer to assess the company's physical assets, inventory and operations firsthand.

The buyer's due diligence team may also hold discussions with management, key employees, customers, suppliers and other stakeholders. This helps buyers gain insights into the company's culture, strategies, relationships, reputation and challenges.

5. Analysis, Validation and Risk Assessment

The analysis involves evaluating various aspects of the target company. Validation, on the other hand, ensures the accuracy and reliability of the information obtained.

The team checks the target company's data by comparing it with data from other sources. Any discrepancies or anomalies are thoroughly investigated.

After reviewing all the necessary documents and conducting site visits and interviews, the buyer's due diligence team will analyze the company's valuation.

They will consider projected earnings, growth potential, market share and competition to determine whether the asking price is reasonable.

The due diligence process also includes a risk assessment, where the buyer identifies potential risks associated with the acquisition. These risks may include regulatory hurdles, legal disputes, environmental issues, or other factors affecting the company's profitability or reputation.

These processes are iterative and involve cross-referencing data from different sources to paint a complete and accurate picture of the target company.

6. Documentation and Report Preparation

After the risk assessment, the due diligence team compiles the due diligence report. The report summarizes findings, highlighting key risks, opportunities and recommendations.

The report also includes relevant documents, contracts, financial statements and other evidence that supports the findings.

We’ve shared everything you need to include in a due diligence report. However, if you need help with ideas or a draft for your report, Visme’s AI text generator is your best bet. All you need to do is input an accurate prompt and you’ll get results in seconds. You can also use the tool to get more context or proofread your due diligence report.

Remember to keep your report aligned with your company's brand identity. With Visme's brand wizard, you can ensure your due diligence report has a cohesive look and feel. Just input your URL and watch the wizard unleash its magic.

7. Decision-Making and Negotiation

The investor or buyer evaluates the due diligence report to make an informed decision about the investment, acquisition, or partnership.

Based on the findings, the buyer may choose to negotiate the purchase price or terms of the sale. If the due diligence process reveals significant issues, the buyer may decide to walk away from the deal.

8. Closing the Deal

Once the parties have agreed on the terms, legal agreements are finalized and the transaction is closed. Throughout the due diligence process, it’s essential for all parties involved to communicate and collaborate effectively.

Visme has a wide range of tools that streamline collaboration and communication for teams of all sizes. Everyone on the team can tag each other, leave comments and reply to comments on due diligence reports.

The workflow feature lets you assign different sections of the due diligence reports for team members to work on and even add due dates.

For example, you can assign the legal due diligence section to the legal experts to work on. You can require specific users in your workspace to get approval before publishing, sharing or downloading the report.

Visme allows you to download and share your report in multiple formats. You can share your report via an online link or generate an embed code.

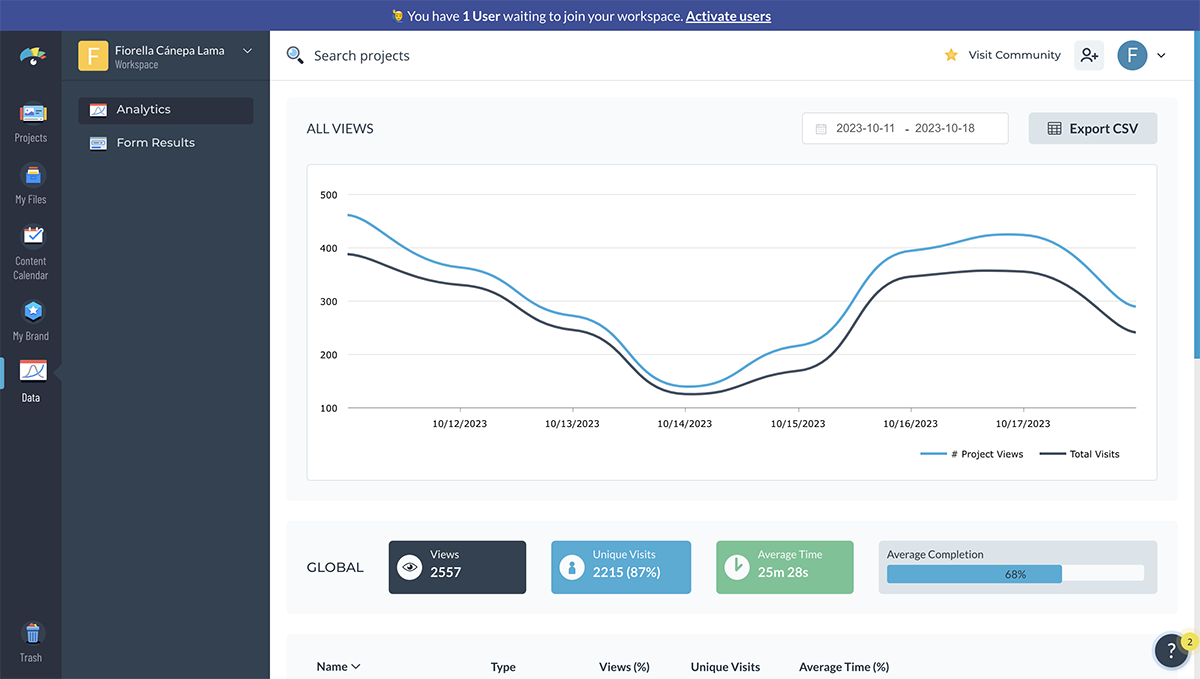

Or download your due diligence reports in PDF, PPTX, PNG, JPG and more. Once you’ve shared your report, you can monitor how readers engage with it using Visme analytics.

Due Diligence Checklist

A due diligence checklist is an extensive list of items that should be reviewed and verified during the due diligence process.

This checklist acts as a roadmap, ensuring nothing falls through the cracks during the evaluation process. The content of the checklist may vary based on the nature of the transaction and the industry involved.

Here’s a checklist template to streamline your due diligence process. Feel free to include additional items based on your requirements.

Your checklist doesn’t have to be boring. Elevate your due diligence checklist with Visme’s icons, stock photos and videos. If you work with multiple teams or clients, you can customize your checklist for different types of due diligence using dynamic fields.

Due Diligence FAQs

The team of professionals and experts involved in the process is responsible for writing a due diligence report. These professionals include financial analysts, lawyers, industry specialists, market analysts, project managers, consultants and due diligence firms.

Generally, professionals in finance, accounting, law, operations, IT and market analysis can conduct due diligence investigations.

The responsibility for performing due diligence falls on the party or parties involved in a business transaction, such as investors, acquirers, lenders, business partners, business brokers, legal and financial advisors, consultants, due diligence firms and internal audit teams.

There are three primary levels of due diligence.

- Simplified Due Diligence. This is the lowest level of due diligence. It is commonly used in transactions or situations with limited resources or detailed analysis might not be feasible. Simplified due diligence assesses the most critical aspects of a business transaction without delving into detailed investigations.

- Standard Due Diligence. This is the most common type of due diligence. It involves a thorough analysis to assess the risks and opportunities associated with the transaction. This type of due diligence is commonly used for moderate-risk business transactions, mergers, acquisitions or investments.

Enhanced Due Diligence. This level of due diligence offers greater scrutiny of potential business transactions or partnerships. It is primarily deployed in high-risk transactions, such as dealing with politically exposed persons or high-value investments in emerging markets.

The specific requirements of a due diligence report can vary based on the nature of the transaction and the parties involved. However, a standard due diligence report should include the following components:

- Executive summary

- Company overview

- Purpose and objective of the diligence

- Financial due diligence

- Legal due diligence

- Operational due diligence

- Market and commercial due diligence

- Risk assessment

- Conclusion and recommendation

- Supporting documents

- Appendices

The 3Ps of due diligence are people, process and performance.

- People. This aspect focuses on the human capital within the company, including the leadership team and key employees. It involves assessing their abilities, experience, track record and potential impact on the business.

- Process. This element involves evaluating the internal workings of the company. The goal is to ensure that operational, financial and administrative procedures are efficient and compliant with legal and regulatory standards.

- Performance. This encompasses evaluating the company’s financial health, market standing and strategic direction. This component provides insights into the company’s overall performance and potential for future success.

By thoroughly assessing people, processes and performance during due diligence, investors can fully understand the target company’s capabilities, operational efficiency and growth potential.

Compliance focuses on meeting legal and regulatory requirements. Due diligence involves thoroughly investigating various aspects of a business transaction to make informed decisions.

Due diligence often includes assessing compliance as one of its components. However, it goes beyond compliance by evaluating the overall health and potential of the target company.

Here are several key components typically included in a financial due diligence report to provide a comprehensive analysis of the financial aspects of a business or investment opportunity.

- Financial Statements: Include a detailed analysis of the company’s financial statements, including the balance sheet, income statement, and cash flow statement.

- Revenue and Cost Structure: An examination of the company’s revenue sources and cost structure

- Financial Ratios and Key Performance Indicators (KPIs): Capture ratios such as liquidity ratios, profitability ratios, and debt ratios.

- Historical Financial Performance: Review the company’s historical financial performance to identify trends, patterns, and potential red flags,

- Taxation and Compliance: Evaluate the company’s direct and indirect tax obligations, compliance with tax laws, and any potential tax risks or contingencies.

- Asset and Liability Analysis: Assess the company’s assets, liabilities and capital structure.

- Cash Management and Working Capital: Share information about the company’s cash flow management, working capital requirements, and capital expenditure analysis

- Financial Forecast and Projections: Provide forward-looking financial information, including financial forecasts, budget plans, and revenue projections.

- Audit and Control Environment: Evaluate the company’s internal controls, audit reports, and compliance with accounting standards.

- Risks and Opportunities: The report should identify and analyze potential financial risks, opportunities, and challenges that could impact the company’s financial health.

Easily Create Detailed Documents & Reports with Visme

A due diligence report is a prerequisite for finalizing a legal agreement, whether it's a business transaction, investment, merger or acquisition.

In this guide, we explained how to prepare a due diligence report that helps you make insightful and winning decisions.

You can identify risks that should be avoided or tackled early on and negotiate favorable terms.

However, you need the right due diligence tools to not only guide you through the process but also organize your findings into a report.

Visme's report maker makes it easy to create a due diligence report and any other business or legal document—you don't need to be a professional designer.

Search the extensive template library for a due diligence report template. Or simply customize the ones we’ve shared in this article to meet your unique needs.

Feel free to swap the colors, text, icons and other visual elements to match your brand. Easily collaborate and communicate with the rest of your team on the report and access a vast range of download and sharing options.

Sign up for Visme to create stunning documents, reports and other visual content!

Create Stunning Content!

Design visual brand experiences for your business whether you are a seasoned designer or a total novice.

Try Visme for free

![How to Create a Practical Crisis Management Plan [+ Templates]](https://visme.co/blog/wp-content/uploads/2025/07/How-to-Create-a-Practical-Crisis-Management-Plan-Thumbnail.png)