Insurance Marketing: The Complete Guide for Agents & Teams in 2026

Insurance marketing plays by a different set of rules.

Unlike the traditional marketing playbook, you’re not selling a tangible product or an instant payoff.

You’re selling trust, reassurance and protection against risks customers hope they’ll never face.

At the same time, you’re making that pitch alongside thousands of other companies saying virtually the same thing while navigating strict compliance requirements. That changes everything about how you approach marketing.

So how do you push the boundaries of what’s possible? To succeed, you need a proven strategy to build trust with potential and existing customers, attract new clients, and retain them over time without compromising compliance.

In this playbook, I'll share everything you need to know to create marketing campaigns that stand out from the competition.

You'll discover proven strategies for every channel and level of insurance marketing, along with the tools and templates you’ll need to reach your objective. You’ll also see real examples from insurance brands and get practical tips you can put into action immediately.

Before you start reading, highlighting and taking notes, open the video below in a new tab and bookmark it for later. It’ll show you exactly how to create branded, compliant content to help you land more insurance clients, win trust and scale your sales.

Let’s get started.

Disclaimer: Visme is a design and visual communication platform and is not intended for the storage, processing, or transmission of sensitive insurance, financial, or personally identifiable information (PII). Users are responsible for ensuring that their use of Visme complies with applicable insurance, data protection, and privacy regulations.

Insurance marketing is the process of promoting insurance products and services to potential and current customers. The goal is to build trust, educate about coverage options and guide prospects through the decision-making journey towards purchasing policies and maintaining them.

Like all marketing, its objective is to identify, attract, engage and retain customers. But unlike traditional marketing, insurance marketing is unique in that it sells an intangible promise of future protection while operating within a highly regulated environment.

There’s no physical product on display or a service that shows results immediately. That’s why the best insurance marketing makes intangible offerings feel tangible through storytelling, relatable scenarios and emotional resonance.

Perfecting your insurance marketing strategy is highly important. As Danielle Waller, a State Farm insurance agent in North Carolina, explains:

“People are looking you up before they ever decide if they want to work with you. They’re going to look you up online, they’re going to look at your reviews, they’re going to figure out who you are and what you do before they ever give you an opportunity.”

Insurance marketing operates across three levels: the carrier, the agent and the broker. Together, they help account for the projected $14 billion spent on insurance-based digital ads in 2026.

At the carrier level, insurance companies focus on building brand awareness, establishing market position and creating (and maintaining) an identity. Here are some great examples:

These companies invest in large advertising campaigns, sponsor major event and create educational content at scale. Their marketing budgets are typically in the millions per year.

Insurance agents represent one or more insurance carriers and work directly with customers to assess their needs and recommend appropriate coverage. Insurance agent marketing focuses on building a local presence, establishing credibility through personal branding and creating relationships that lead to sales and referrals.

Agents can be independent service providers or part of a larger agency environment with several agents, often grouped into the types of insurance they sell. These subgroups do insurance marketing a bit differently, but they are still similar.

Insurance brokers differ from agents in that they work on behalf of the customer, not the insurance company. They compare policies across multiple carriers to find the best fit for their client’s needs.

Regarding marketing, brokers must position themselves as unbiased advisors working in the customer’s best interest. This is the foundation for their personal branding strategy.

Aside from these major types of insurance marketing, there’s also B2B and B2C insurance marketing.

Some insurance companies focus on one of the two, while others focus on both.

This separation is becoming blurry, according to Zean from Behind Marketing Lines.

“The distinction between B2B and B2C in insurance marketing is blurring in interesting ways. Platforms like TikTok and Instagram aren't just for B2C. They are powerful tools for all industries."

B2C insurance marketing targets individuals and families purchasing personal coverage like auto, home, life, health or renters insurance. These campaigns focus on emotional storytelling, simplifying complex concepts and building trust with everyday consumers who may not fully understand insurance terminology.

B2B insurance marketing targets businesses that purchase commercial coverage, such as general liability, workers' compensation, cyber insurance, professional liability, or commercial auto policies. These campaigns emphasize risk mitigation, compliance requirements and industry-specific expertise. The sales cycle is longer, involves multiple decision-makers and requires more detailed educational content.

When planning an insurance marketing budget, do your stakeholders ask if marketing really is worth investing considerable time and money on? Do they question if maybe the brand can survive on its positive reputation and word of mouth alone?

As a professional marketer, you can make a point of how great insurance marketing can deliver measurable returns that go far beyond what referrals can achieve on their own.

Share the following benefits and build your strategies around them.

When prospects see your content, ads and social media presence consistently over time, your brand becomes a familiar name. This growing familiarity breeds trust as long as your communication is trustworthy. It increases the likelihood that they’ll choose you when they’re ready to convert. Then, depending on how your reps act and what they share with policyholders during times of crisis, it will inspire them stick around for the long run.

On the flip side, if you’re inconsistent with your marketing, you risk losing clients. According to Carl Willis from Agent Branding & Marketing:

“Many insurance agencies don’t lose business because of bad service — they lose it because they disappear. When marketing is inconsistent, potential clients forget your name, lose trust, or choose the agent who stays visible while you go quiet. One month of activity followed by silence breaks momentum, weakens authority, and slows lead flow without you realizing it.

Consistent marketing isn’t about posting more. It’s about staying present, staying relevant, and staying top of mind when prospects are ready to act. That’s where a system matters more than effort.” -

One of the biggest challenges an insurance professional can face (especially independent agents and brokers) is the feast-or-famine reality, which disrupts stable business functions. But with consistent marketing campaigns directly aligned with the customer, your efforts can generate a steady stream of qualified prospects to nurture and convert.

Insurance is complex, and many people don’t understand it well. By creating helpful, educational content that answers common questions and demystifies insurance concepts, you can position your brand as a trusted advisor. Expert positioning leads to higher-quality leads, easier sales conversations and clients who feel they understand what they’re paying for.

It’s vital to be present in the channels where you can reach potential clients, and with insurance, the possibilities are quite varied. Some people open emails, while others don´t; some are active on one or a few social media channels, and others still answer cold calls. Omnichannel marketing increases your chances of capturing attention at the right moment.

Are you still wondering if insurance marketing is worth it? The data in the infographic below should be enough to convince you.

Still questioning whether insurance marketing is worth the spend? These 2026 stats make it clear: insurers that invest strategically are the ones earning trust, capturing demand and staying competitive.

Made with Visme Infographic Maker

As we’ve seen, competition is high in the insurance industry. So, you’ll need the right marketing strategy to consistently get results.

In this section, I’ll break down several tactics that are actually working for insurance marketers, agents and brokers in 2026. I share real examples and practical implementation tips.

Search engine optimization (SEO) is fundamental to digital marketing. But things are changing fast, and now, so is Answer Engine Optimization (AEO).

Take note of these tips for implementing both SEO and AEO:

And that’s where content marketing comes into the picture. For starters, you must feed both SEO and AEO with content to show up in search engines and AI platforms. But also, your content must be educational and inspire trust, as I mentioned earlier.

The most useful types of high-performing insurance content include:

A company blog will provide immediate value to your customers and position you as a helpful resource. In your blog, share medium- and long-form content that addresses common insurance questions and explains complex concepts.

Think of topics like "10 Ways to Lower Your Auto Insurance Premiums" and use stories that readers can relate to.

MetLife, for example, excels at content marketing with their blog, Met Stories. The team uses storytelling to cover a range of insurance topics, including health, retirement planning, workplace benefits, and financial literacy. Through this blog series, MetLife provides valuable information to help its target audience make better decisions and build long-term relationships.

Longer-form content to explain topics that require deeper explanation. These can be valuable lead magnets for lead generation by offering them in exchange for contact information.

The example below is a landing page from CoverLink Insurance, where interested prospects can download an ebook titled “Is Life Insurance Worth the Time and Cost?”

With this resource, the customer can learn about the importance of life insurance on their own time. Then, hopefully, they will get in touch with CoverLink to ensure a life insurance policy.

Real examples of how you've helped clients solve problems or achieve outcomes. These can build credibility and help prospects envision working with you.

Sonant.ai's analysis of insurance SEO found that companies focusing on location-specific content combined with service-specific pages performed significantly better than those with generic content. For instance, an agency creating separate, optimized pages for "homeowners insurance in Austin" and "renters insurance in Austin" outperformed competitors with a single "Austin insurance" page.

Email marketing remains one of the highest ROI channels for marketers.

But for insurance marketing, it’s far from foolproof. In fact, insurance has one of the lowest click-to-open rates across all industries at just 3.19%, compared to the cross-industry average of 6.81%.

The main challenge you face with email as an insurance marketer is building trust around products people don't understand and hope they'll never use, all while ensuring every email remains compliant.

Plus, you must follow state privacy laws in at least 12 states and industry-specific rules about what you can claim about coverage and pricing.

All these factors affect your emails’ deliverability because automated, behavior-led campaigns can easily trigger spam filters. So, insurance email marketing must strictly follow federal CAN-SPAM requirements to ensure your emails don’t end up in your recipients’ spam folders.

Taking all that into consideration, here are some of the most effective email marketing strategies that work:

Social media as a strategy for insurance marketing is a bit more challenging than in other industries. Since insurance isn’t inherently visual, you need to be more conceptual.

Regardless, your potential customers are on social media, so don’t skip this channel completely. Your clients will not only expect to find you on social media, but they will also search for your profiles to see what you post and how you reply to comments.

On social media, you have three options:

I’ve grouped some social media best practices by platform to give you an overview of what’s possible.

Despite digital marketing being so big, print advertising still holds value in insurance marketing, particularly for building awareness and credibility. According to a 2024 MarketingSherpa study, 82% of consumers trust print ads when making purchasing decisions, compared to 71% who trust online ads.

Print insurance campaigns in magazines, street posters and flyers typically focus on emotional storytelling, clear value propositions and strong visual concepts that communicate protection and peace of mind.

These campaigns work especially well for insurance because they offer:

Here are a couple of examples from different insurance brands. The first one is from Canadian Insurance Center, it’s their ________ Happens campaign. This print ad shows a man who’s been electrocuted, with his hair standing on end and his skin blackened. But the styling and execution make it more humorous than scary.

This campaign works because it acknowledges that bad things happen without resorting to fear tactics. The humorous angle makes the message memorable and shareable while still driving home the main idea with a short text that says, “Accidents insurance. Made Simple.”

The example below is the print version of a multichannel breast cancer awareness campaign from Allianz. This ad was published in women’s fashion and lifestyle magazines in Europe, tailored to the exact audience that needs this type of information.

To make it easy for women to visit the promoted website, the graphic includes a QR code and URL to the webpage that offers more information.

Video has become one of the most powerful tools in insurance marketing. According to Wyzowl's 2024 State of Video Marketing report, 91% of businesses use video as a marketing tool, and 88% of marketers report that video gives them a positive ROI.

Video works particularly well for insurance because it:

Here are some video types you can try for your insurance video marketing strategies

Out-of-home advertising is all about billboards, bus stop ads and other physical advertising in public spaces. The visuals can be typical pasted paper, 3D creations or digital screens.

According to the Out of Home Advertising Association of America (OAAA), OOH advertising revenue in the United States reached a record $9.1 billion in 2024, cementing the fact that it’s an important strategy in advertising, for insurance and beyond.

These are the most beneficial reasons OOH works for insurance marketing:

Let’s takes look at some OOH insurance marketing examples.

German insurtech Inzmo created a series of eye-catching billboards with bold, colorful designs and direct messaging to reach young urban audiences. The campaign's unique aesthetic and direct copy cut through the noise, making coverage feel accessible and relevant to the community. In the image below, you can see one of the ads on a subway train car.

Hiscox's "The Most Disastrous Campaign Ever" featured billboards that appeared to be water-damaged and burnt, with relatable messaging about business insurance protection. The deliberately "disastrous" executions stopped traffic and generated massive social media coverage, proving that taking creative risks can pay off.

Webinars and live events are another type of insurance marketing that works well for educating potential clients about insurance topics they don’t fully understand or need more information on. These formats allow for relationship building and direct interaction with prospects. It’s also great for lead generation since you can collect a prospect’s email when they sign up for the event.

As long as you know what your ideal client wants, you can create super effective webinars and event series. The data supports it: according to ON24's 2025 Webinar Benchmarks Report, the average webinar conversion rate from registrations to attendees was 57% in 2024, with attendees engaging for an average of 51 minutes.

Those are great numbers and definitely work tapping into.

And these are a few ideas for webinars you can create straight away:

Take, for example, CFC Underwriting, which does B2B insurance marketing through webinars. On their site, they host webinars to educate brokers about new products and company updates.

The screenshots below are from their "Introducing CPR: Cyber Insurance Reinvented" webinar, which brought together industry experts to explain their innovative cyber insurance approach, generating hundreds of qualified broker leads and positioning CFC as a thought leader in cyber coverage innovation.

Insurance is inherently complex and often feels intangible until it’s needed. Interactive marketing can help reduce decision fatigue by making abstract insurance topics easier to understand through personalized recommendations.

The best part about interactive experiences is that as the prospect engages with your calculators, wizards and interactive landing pages, you can also collect data to better understand their specific situations. This information inspires more relevant and personalized communications.

And don’t forget, make them mobile-friendly! People research things like what insurance to get on their phones during downtime. So, make sure your interactive tools work on all devices.

Here are some examples:

These tools help prospects determine how much life insurance, disability coverage, or liability protection they need based on their specific situation.

State Farm, for example, provides multiple financial calculators on their website, including life insurance calculators, retirement income tax calculators and savings calculators.

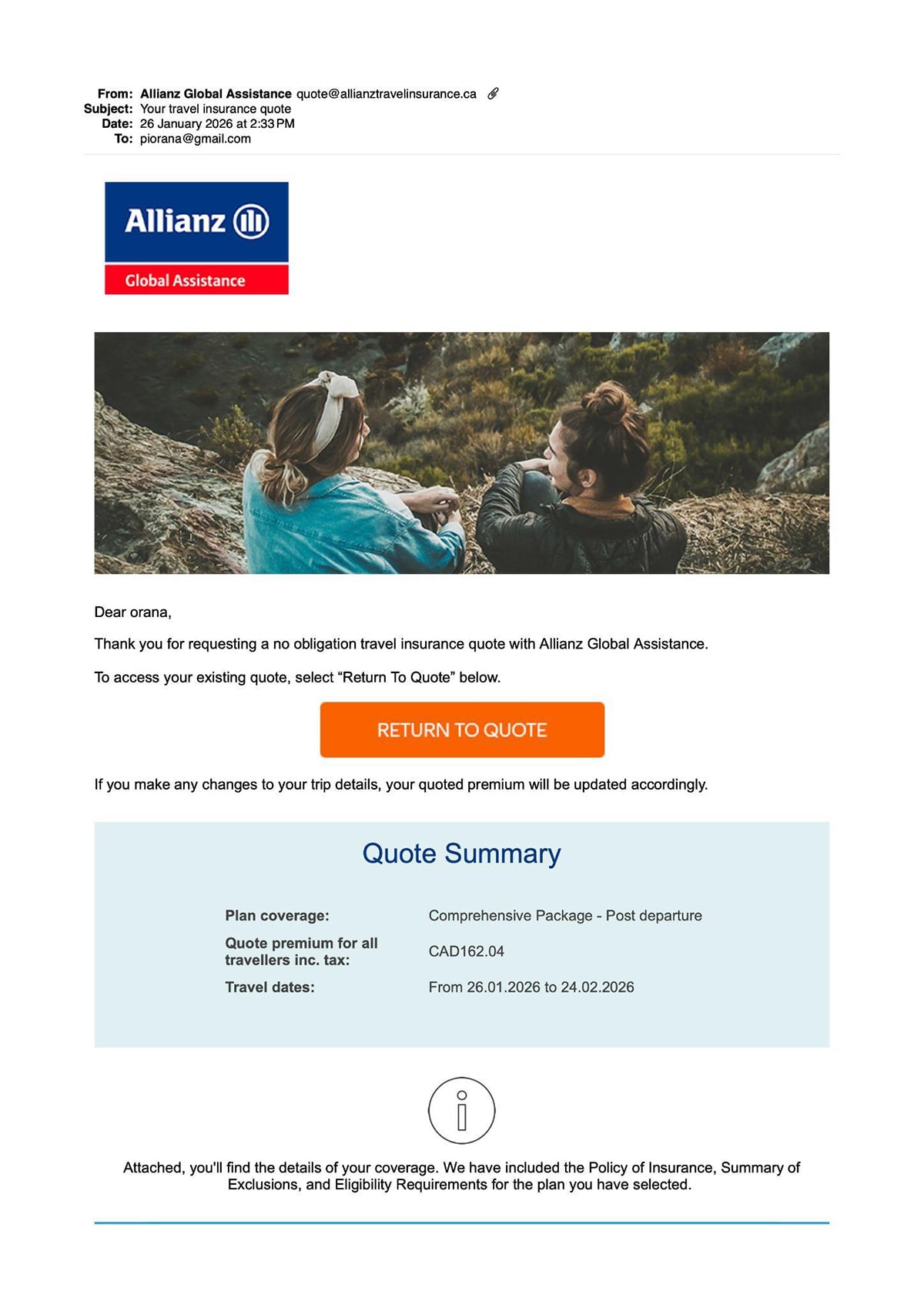

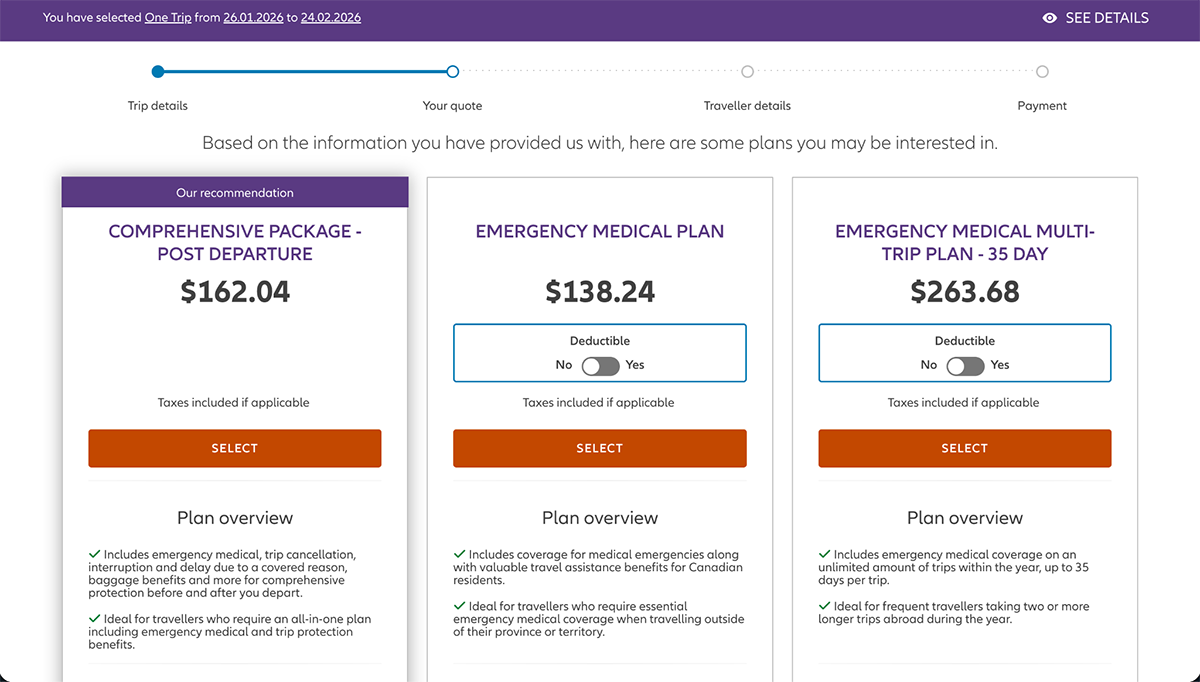

Another carrier, Allianz Insurance Canada, offers a travel insurance cost calculator that a customer fills in and receives an instant response. It’s super simple to fill out without any confusion.

After I added some wanderlust information, I was offered three plans to choose from. After selecting a plan, purchasing is straightforward, and you can also choose to have the quote emailed to you. If you choose the second option, they have your email and will send you correspondence personalized to the form you filled out.

Offer risk assessment tools to help prospects understand their current insurance gaps or business vulnerabilities, then automatically provide remediation suggestions.

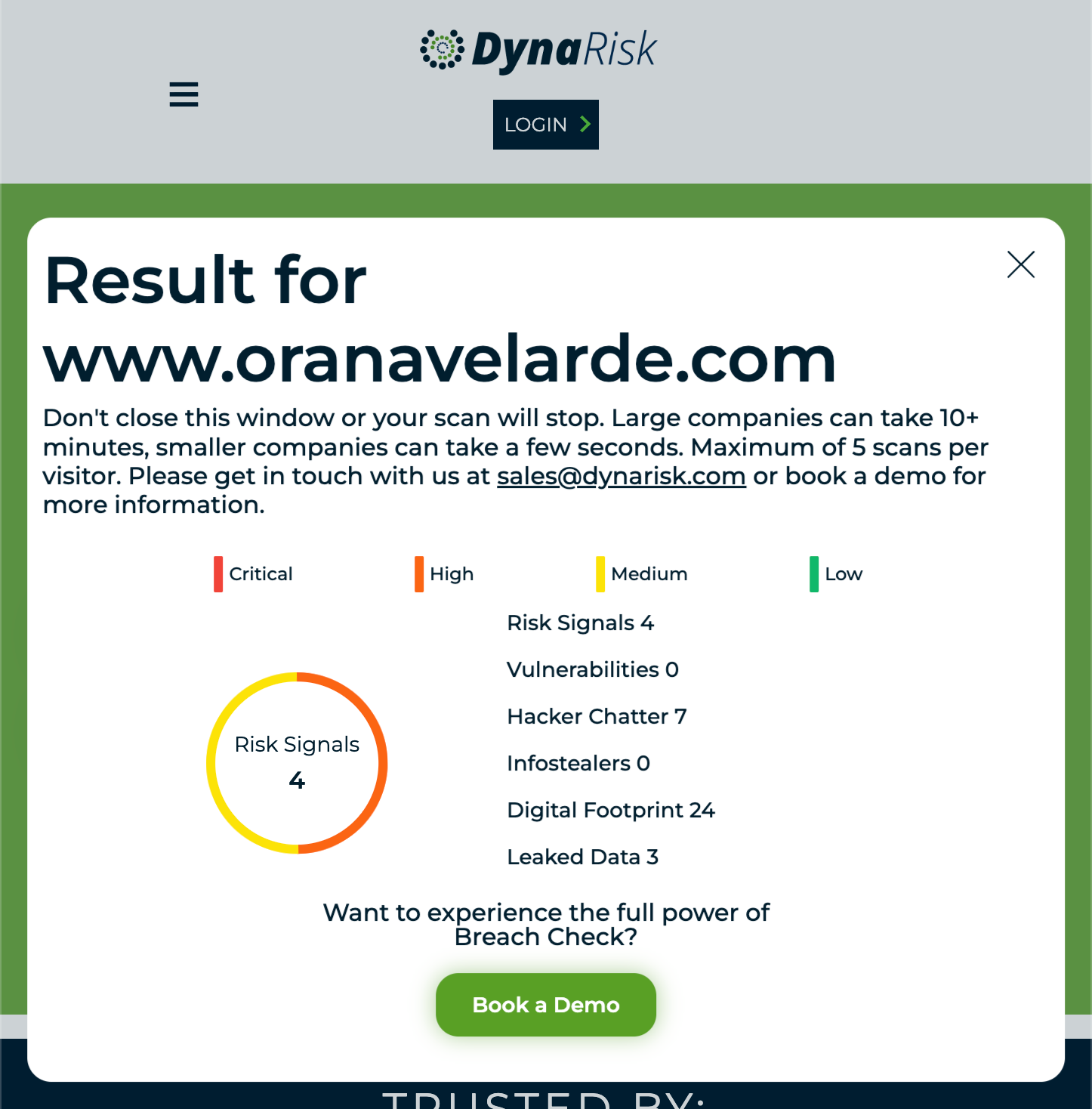

Here’s an example from DynaRisk. It’s a cybersecurity analyzer that you can run on any website. I tested my own website and got results back in a few minutes. All I had to give them was an email address and a URL.

For commercial insurance, tools that calculate the potential financial impact of various claims or losses help business owners understand why adequate coverage matters, making abstract risks feel concrete and urgent.

Zurich Insurance offers this service on their website. Their business interruption coverage calculator is a downloadable Excel-based tool designed to help businesses accurately calculate their coverage needs by evaluating revenue and operating expenses.

The tool uses GAAP (Generally Accepted Accounting Principles) terminology that businesses use routinely, making it easy for financial teams to use.

Visual guides like interactive Infographics that allow users to click through different scenarios, explore various policy types or understand the claims process make complex insurance concepts more digestible and memorable.

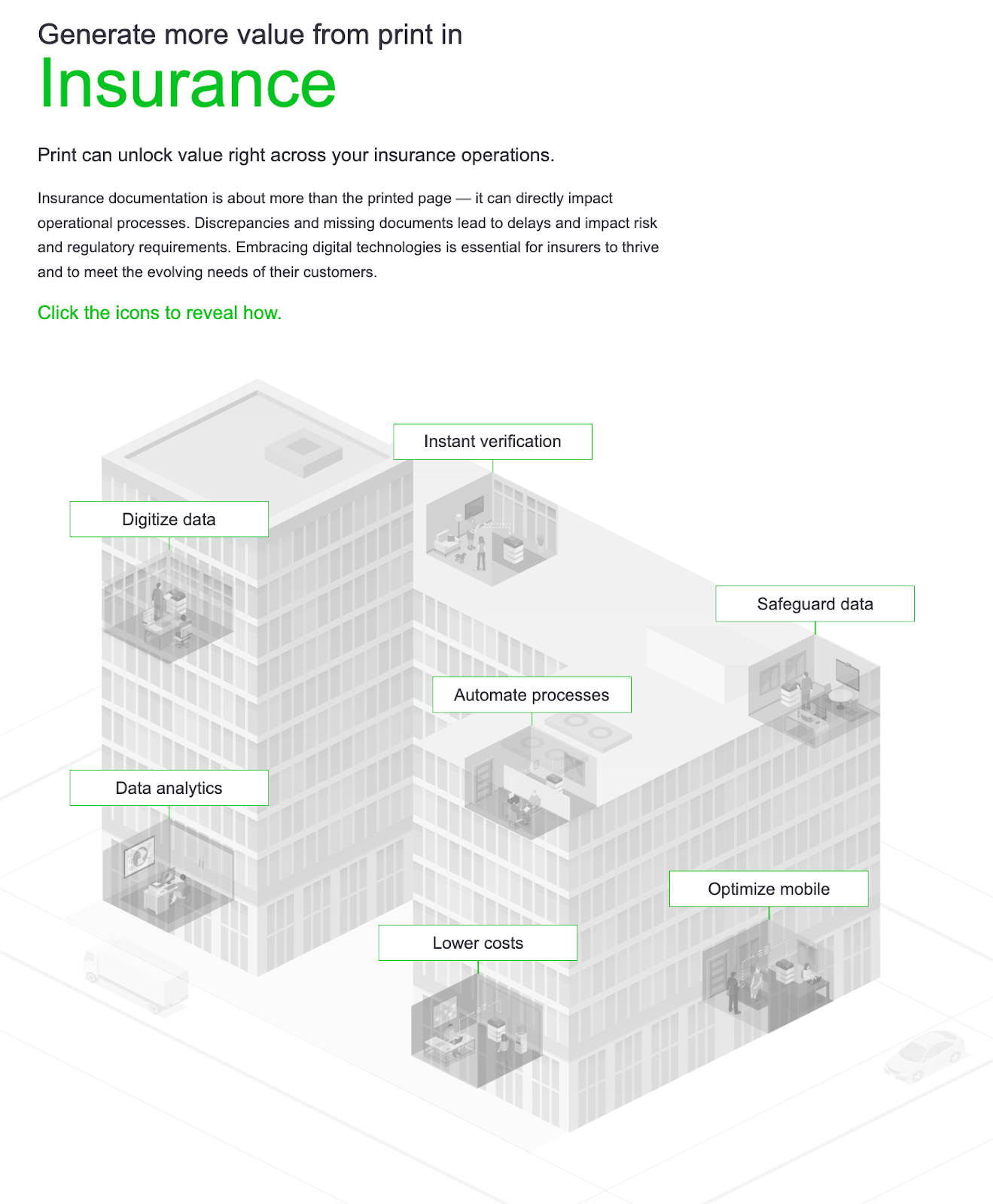

Check out this interactive example from Xerox Lexmark that uses an interactive infographic to explain how digitizing print documentation in insurance helps improve processes and business outcomes.

Similar to interactive infographics, interactive presentations can help communicate with both clients and stakeholders in a more engaging manner. With Visme, you can add interactivity to reports, proposals, policy documentation and more.

With Visme’s interactive features, you can animate any object and make it more memorable. You can also link to other pages, external sites or add hotspots with popups that appear on hover or click.

Finally, you can also add video or audio to the slides. The most useful video feature is the in-slide recording setup so you can record yourself talking to the viewer.

Insurance influencers help make insurance feel less like a necessary evil and more like a smart life or business choice.

Incorporating insurance marketing to your strategies puts relatable voices in front of your audiences, improving your trust factor.

Since insurance is a trust-based purchase, influencers provide the social proof that traditional advertising can only aspire to. They communicate with your potential customers through social media, webinars, email marketing and podcasts.

For insurance brands willing to embrace this campaign type, the opportunity is massive. 86% of consumers make at least one influencer-inspired purchase per year, and 49% of consumers report that influencer content drives their daily, weekly, or monthly purchases.

Influencers exist under several categories. Choose the one that best suits your objectives

In the example below, Samantha Anderl, a freelancer and entrepreneur coach, partnered with SOLO Healthy Business Group. This post is about a webinar she co-hosted with a company representative, and she also published a blog post and several social media posts.

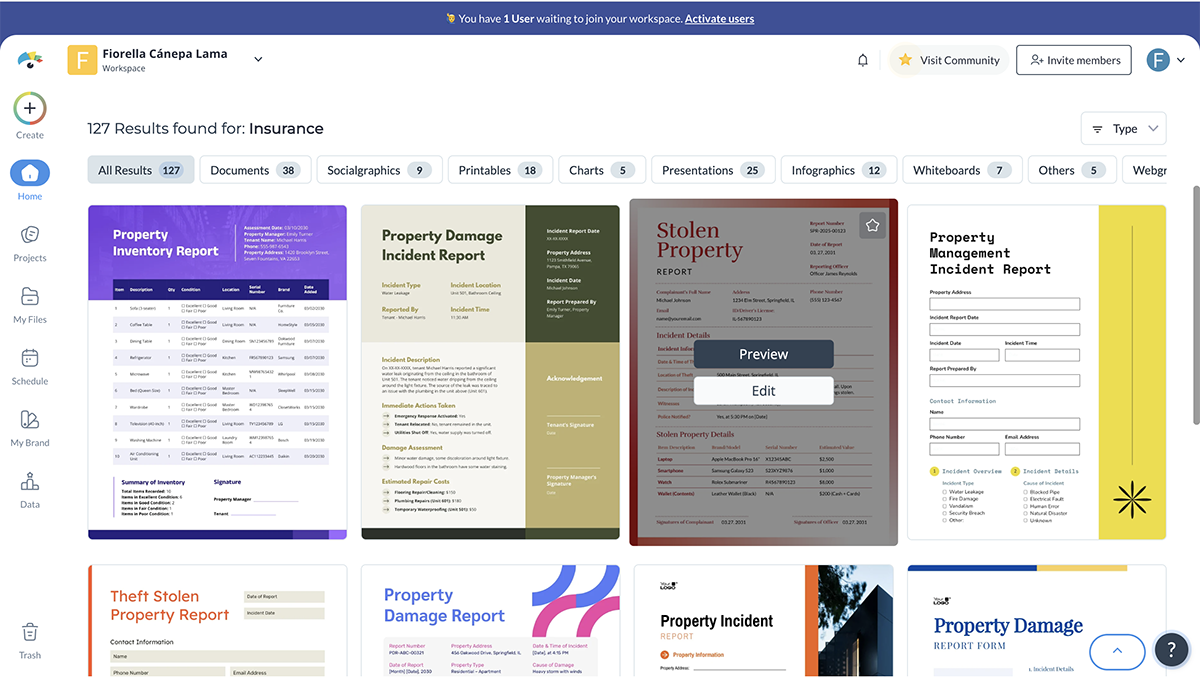

If you’re the one in charge of marketing in your insurance organization, or if you’re an independent agent or broker, you’ll need marketing materials, from internal comms to ready-to-sign contracts.

Your best ally in that department? A Visme account full of easy-to-brand visual templates.

Throughout the section below, I’ll cover the material you likely need and suggest several relevant Visme templates you can use straight away.

Your digital presence is often the first impression prospects have of your business. So, these materials need to look professional, load quickly, and clearly communicate your value and story.

Digital content has a special perk. You can add interactivity. Visme offers many options for that: videos, audio, motion, animation, hover effects, and pop-ups.

Website graphics, such as hero images and promotional banners, can boost engagement. This Insurance Shop template is built specifically for insurance companies looking to highlight different coverage types, with a clean layout, icons and a clear call to action.

Interactive infographics keep people engaged longer than static content. Use this cybersecurity Infographic template to explain insurance topics, like data protection requirements or cyber insurance coverage. You can then embed it on your website or share it via a live Visme link, which you can track with our analytics feature.

Digital flyers and graphics are another great option for digital marketing. Add them to email campaigns or social media promotions using a template like the one below. This insurance company flyer template features two columns for information about why your business is the one to choose.

For display ads to work across your ad channels, they must be created in multiple sizes. The auto insurance leaderboard template below is optimized for the standard 728x90 leaderboard size, but you can easily resize it for other ad placements using Visme's AI Resize.

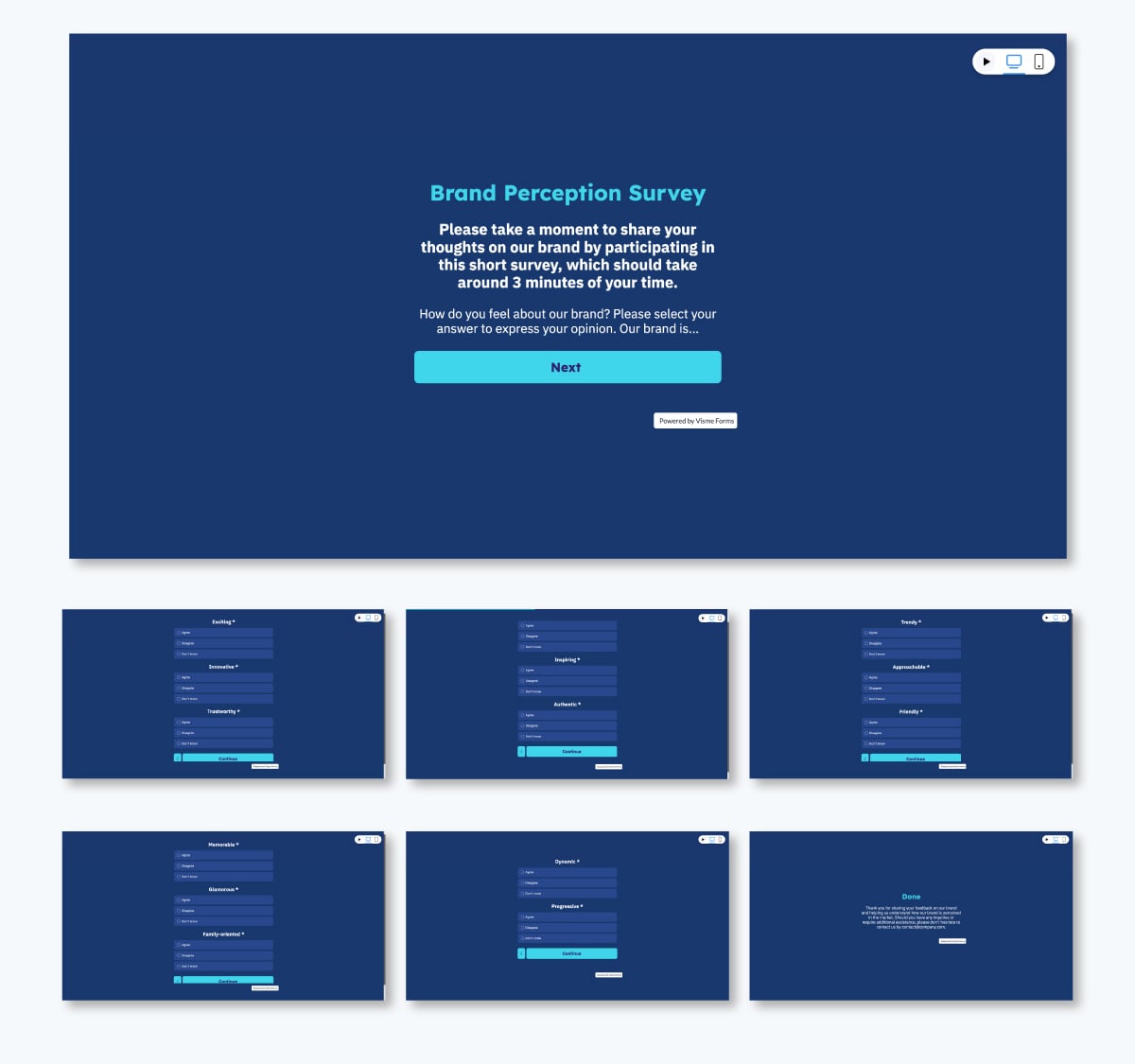

Another practical digital asset you’ll need is a lead-generation form. Using a fully customized, branded Visme Form, you can collect email addresses in several ways, such as by offering free downloads, free consultations, or surveys.

Below is a Visme form you can use to collect sentiment about your company.

Digital (and also print) brochures give prospects something review at their own pace. The template financial services template below will translate perfectly to insurance services. Use it to walk your prospects through available policies, coverage types, pricing tiers or your agency’s unique value proposition.

Proposals are an essential part of communication between agents and clients. And for them to be successful, they need to look polished and professional while also representing your brand and company values. In Visme’s template gallery, you’ll find lots of proposal templates. Here’s one especially designed for insurance organizations.

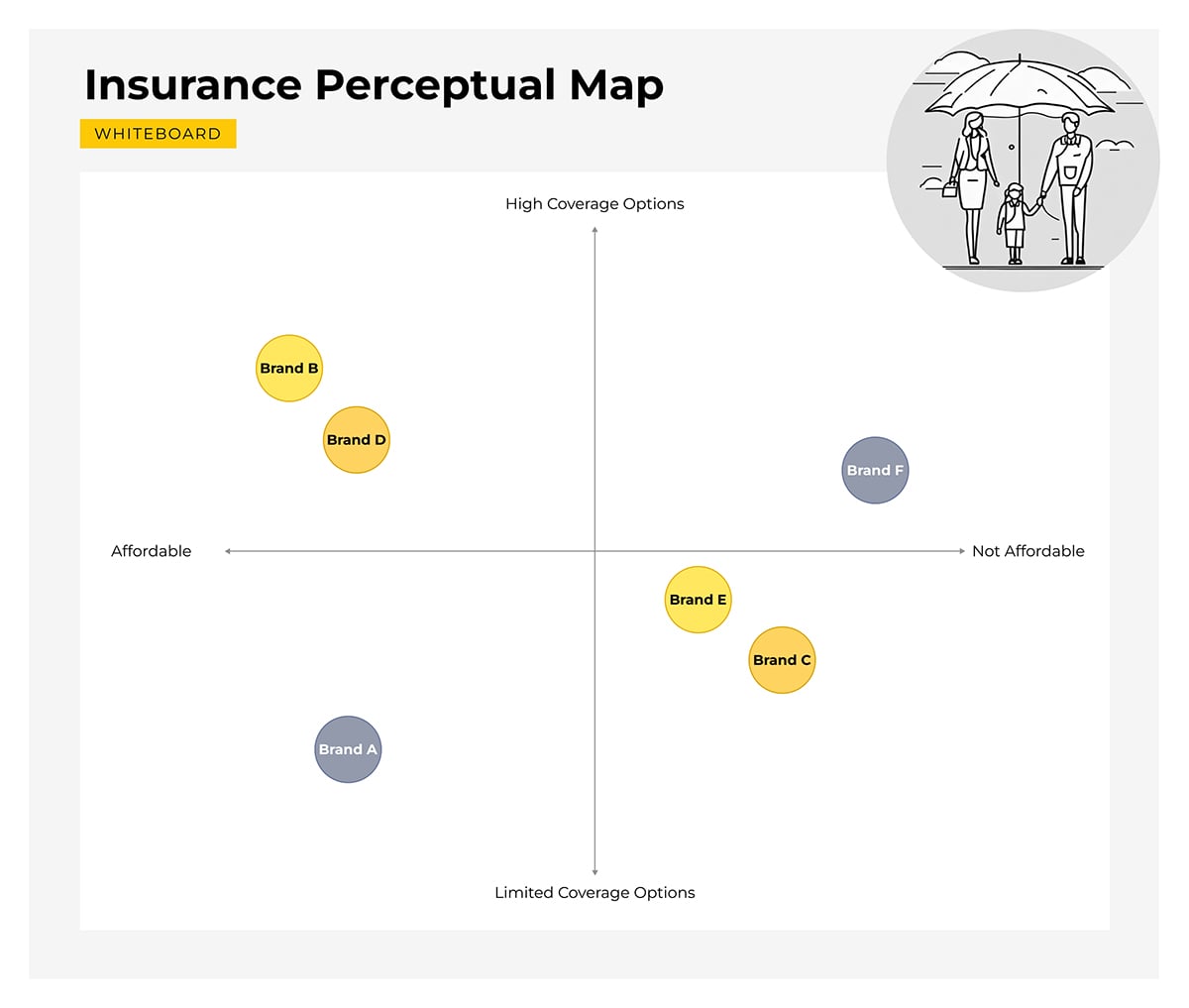

Show your organization's market position or compare the policies you offer using a comparison matrix chart. These work great inside proposals, presentations and even on your website or landing pages. The template below is particularly useful when selling commercial insurance, where businesses need to understand the trade-offs between coverage levels and premiums.

Alongside marketing materials, you’ll need sales enablement material to help you close deals during and after calls and emails with prospects.

Sales battlecards arm your team with quick-reference competitive intelligence, objection-handling scripts and value propositions. The health insurance sales battlecard template below provides a structured format for presenting key selling points and keeping valuable company information front and center during the conversation.

Product portfolios showcase your full range of coverage options in a visually engaging format. This health product portfolio template will help you present multiple insurance plans. Using Visme’s brand features, you can adjust the design to align with your branding.

Market research reports help your sales and marketing teams understand and incorporate industry trends, competitive positioning and customer needs. This document-style report template provides a professional structure for presenting your data, insights and strategic recommendations.

Internal materials keep your team aligned, informed and compliant. These documents support onboarding, training and strategic planning.

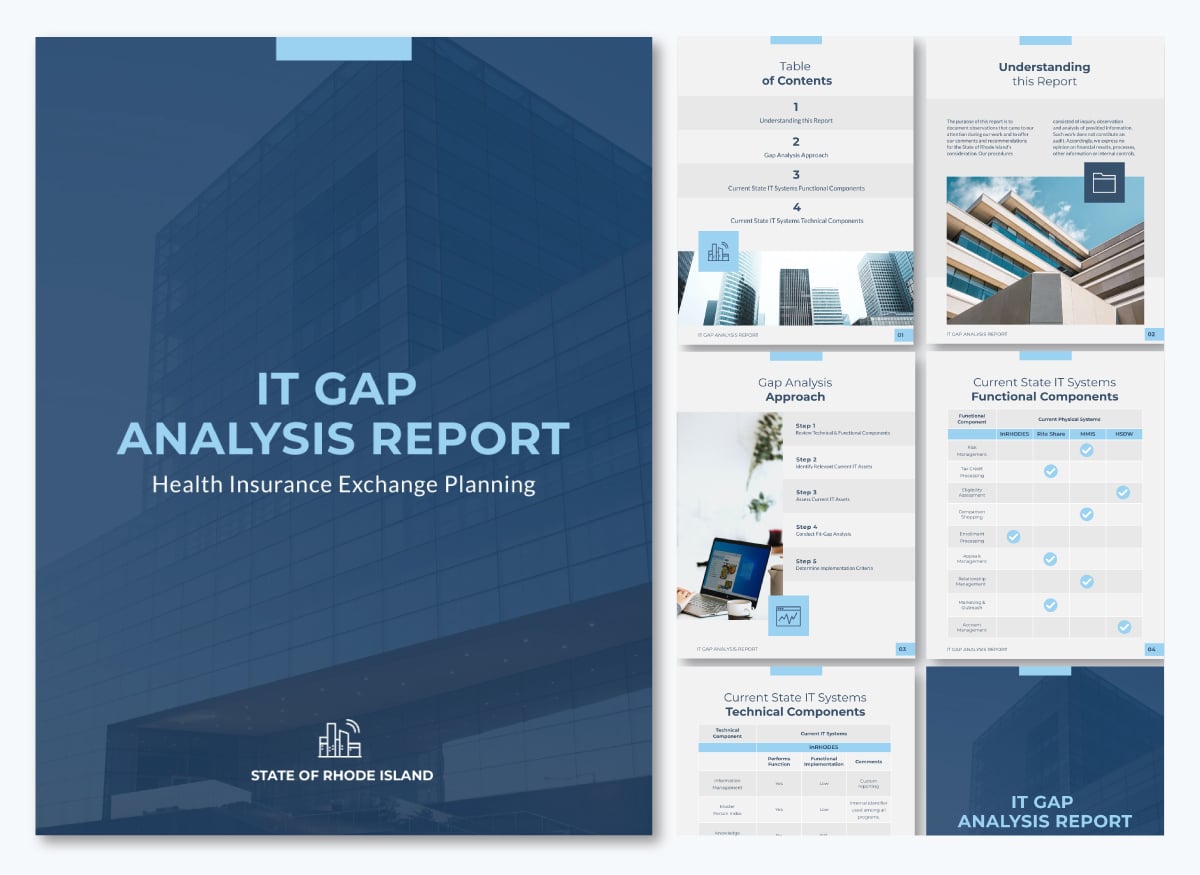

A gap analysis report identifies where your current coverage offerings, processes or capabilities fall short of market needs or business goals. Use this template to visualize the results of your gap analysis and create action plans to improve your team.

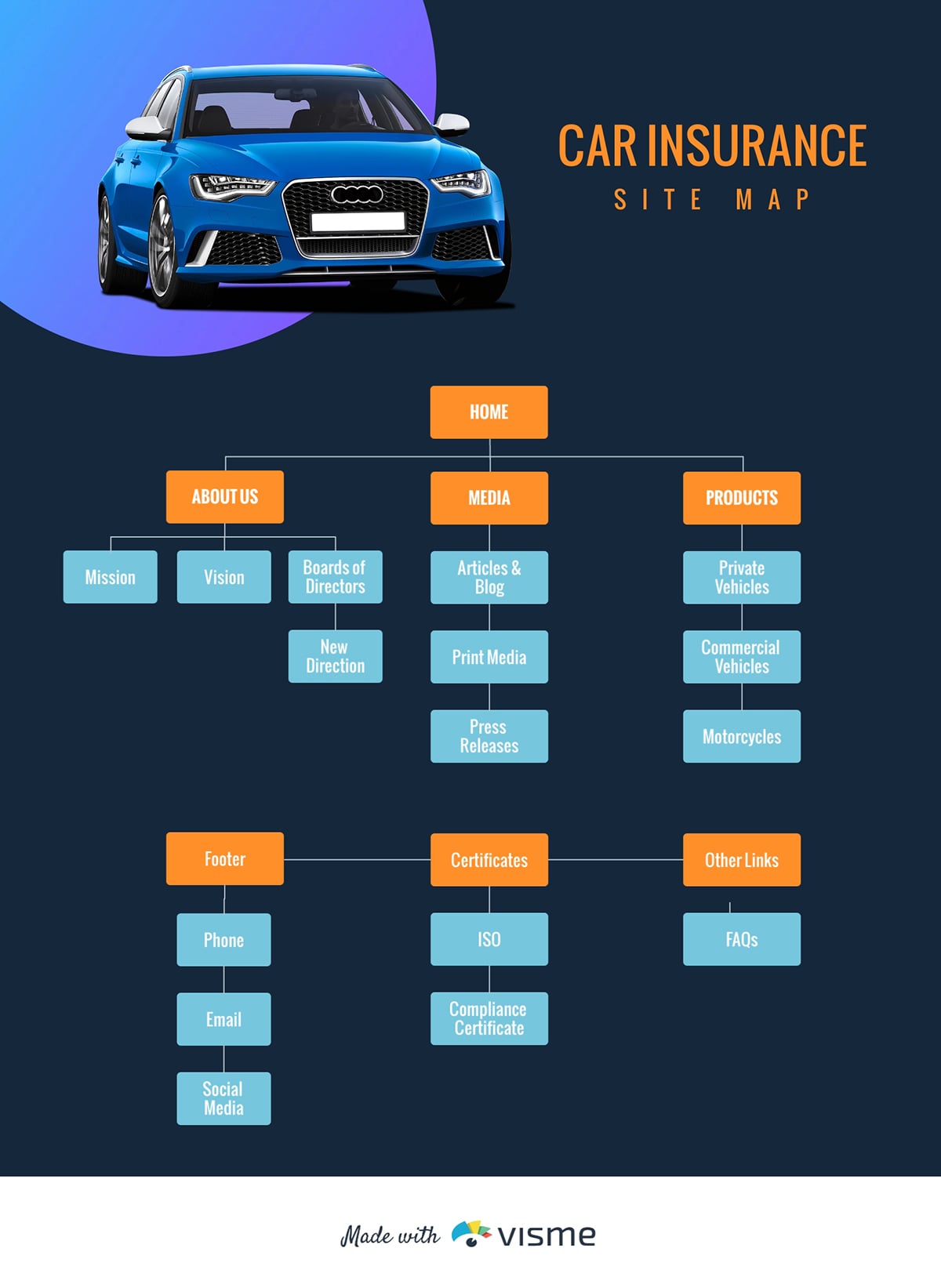

With a visual site map, you can support the planning or optimizing of your website structure. Likewise, you can visualize a customer journey across digital touchpoints. This car insurance site map template organizes a website’s navigation and content hierarchy.

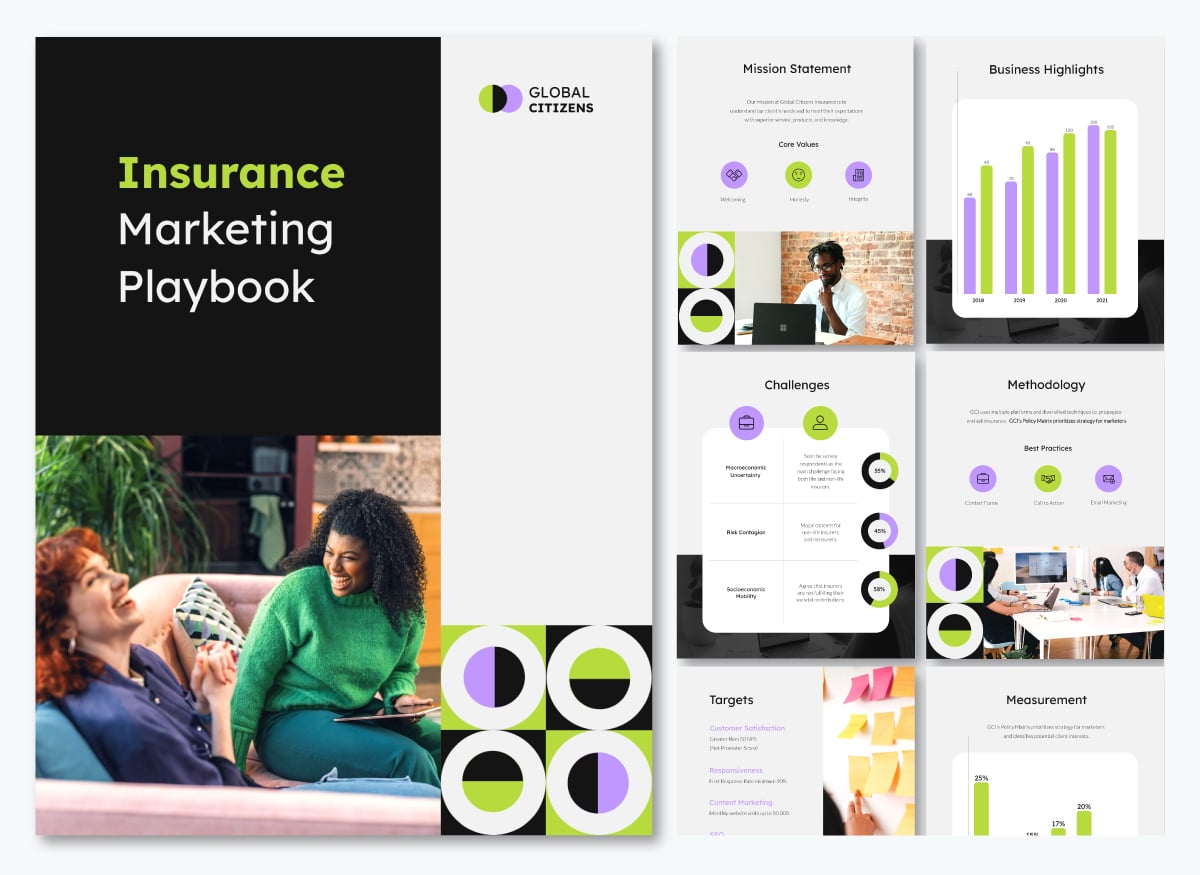

Marketing plans document your strategies, tactics, budgets, and timelines so that everyone on the team can stay aligned, or so you can share them with stakeholders. Using a pre-designed insurance marketing plan example will save you tons of time when building it out with your own content.

Here’s one you can repurpose for your insurance marketing plan.

A marketing playbook will provide repeatable frameworks for common marketing activities. This insurance marketing playbook template includes best practices, workflows, and guidelines that your team can follow to achieve consistent results.

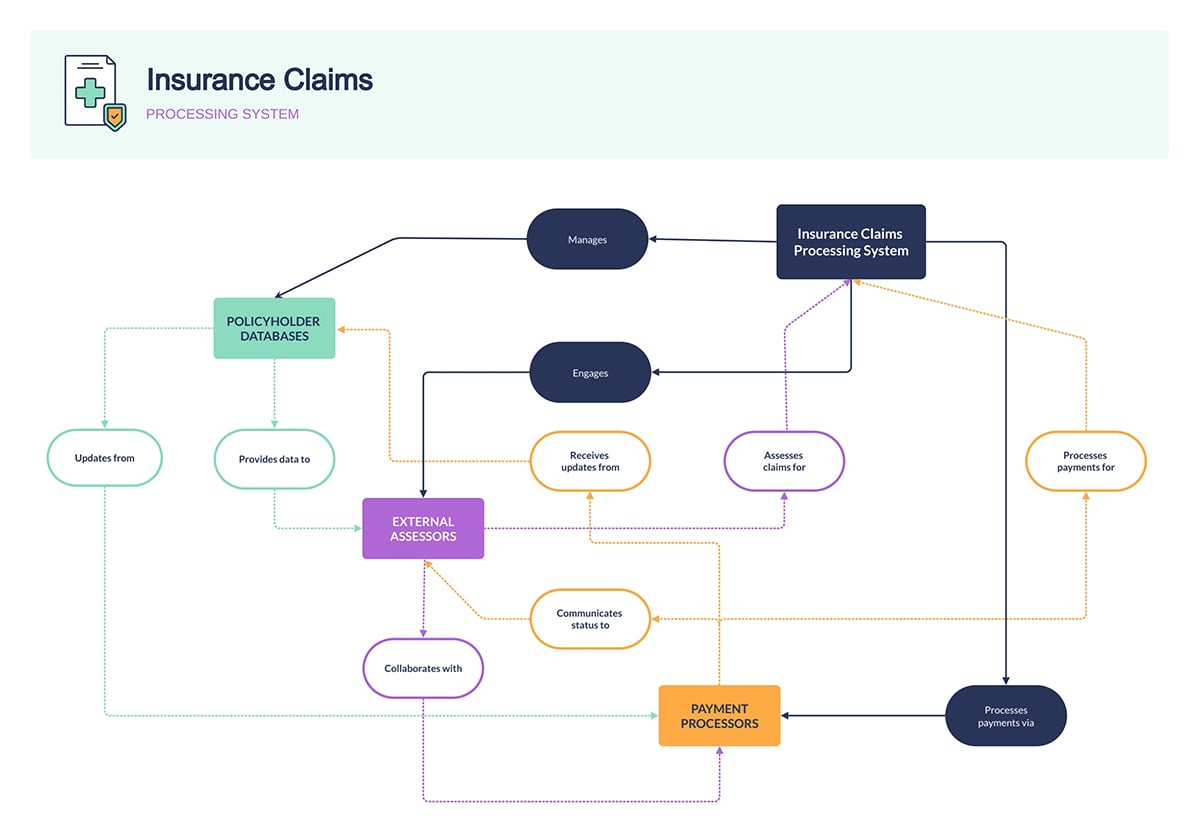

A system diagram visualizes complex processes, data flows and organizational structures. With this insurance claims system context diagram, you can train your teams about how your company’s claims management ecosystem works.

How you communicate during the claims process directly impacts customer retention. That’s why these materials must be easy to use and to feel supportive.

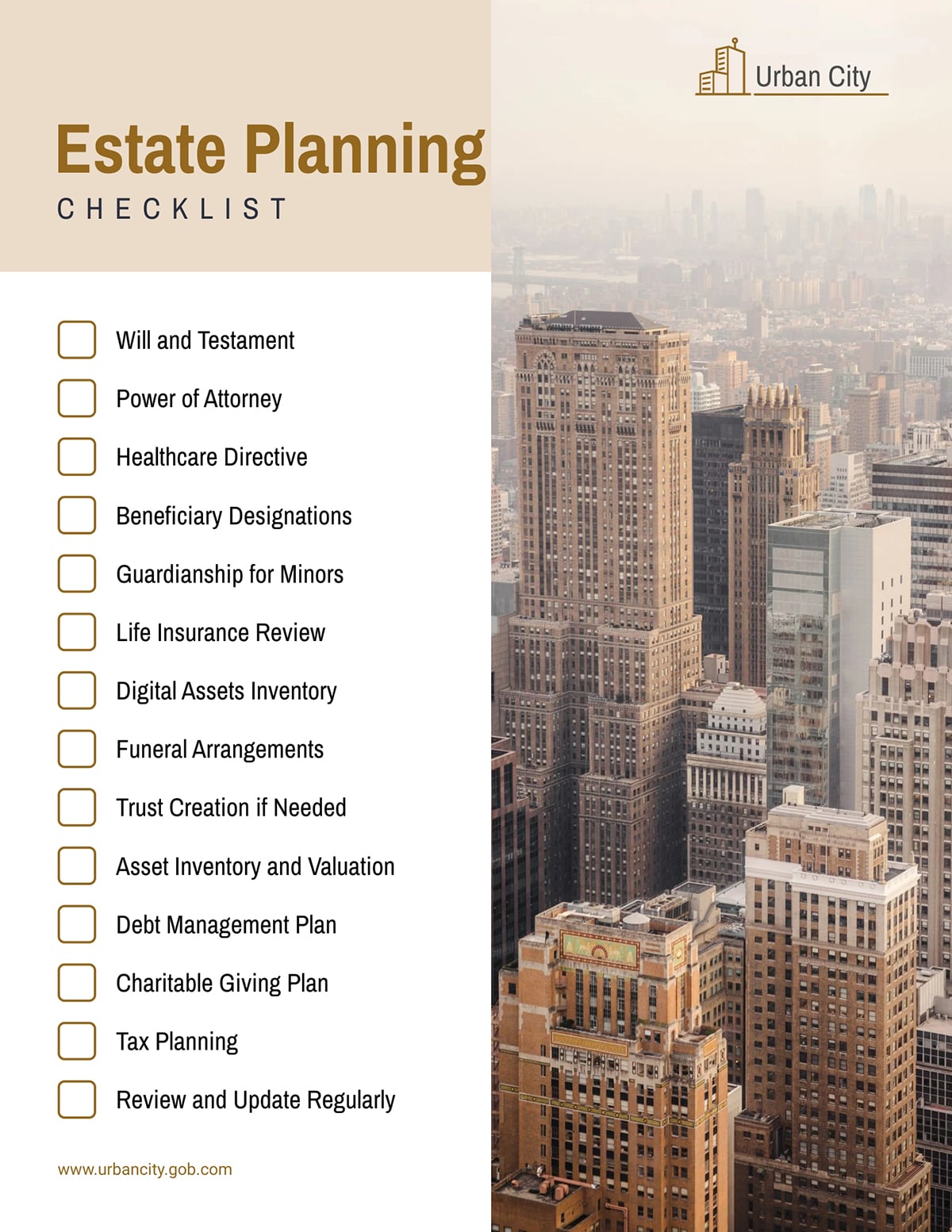

Claims checklists guide customers through the documentation and steps required for different claim types. You can create these for your clients and share them via email or via direct mail. The estate planning checklist template can be adapted for various insurance claims scenarios, ensuring nothing gets overlooked.

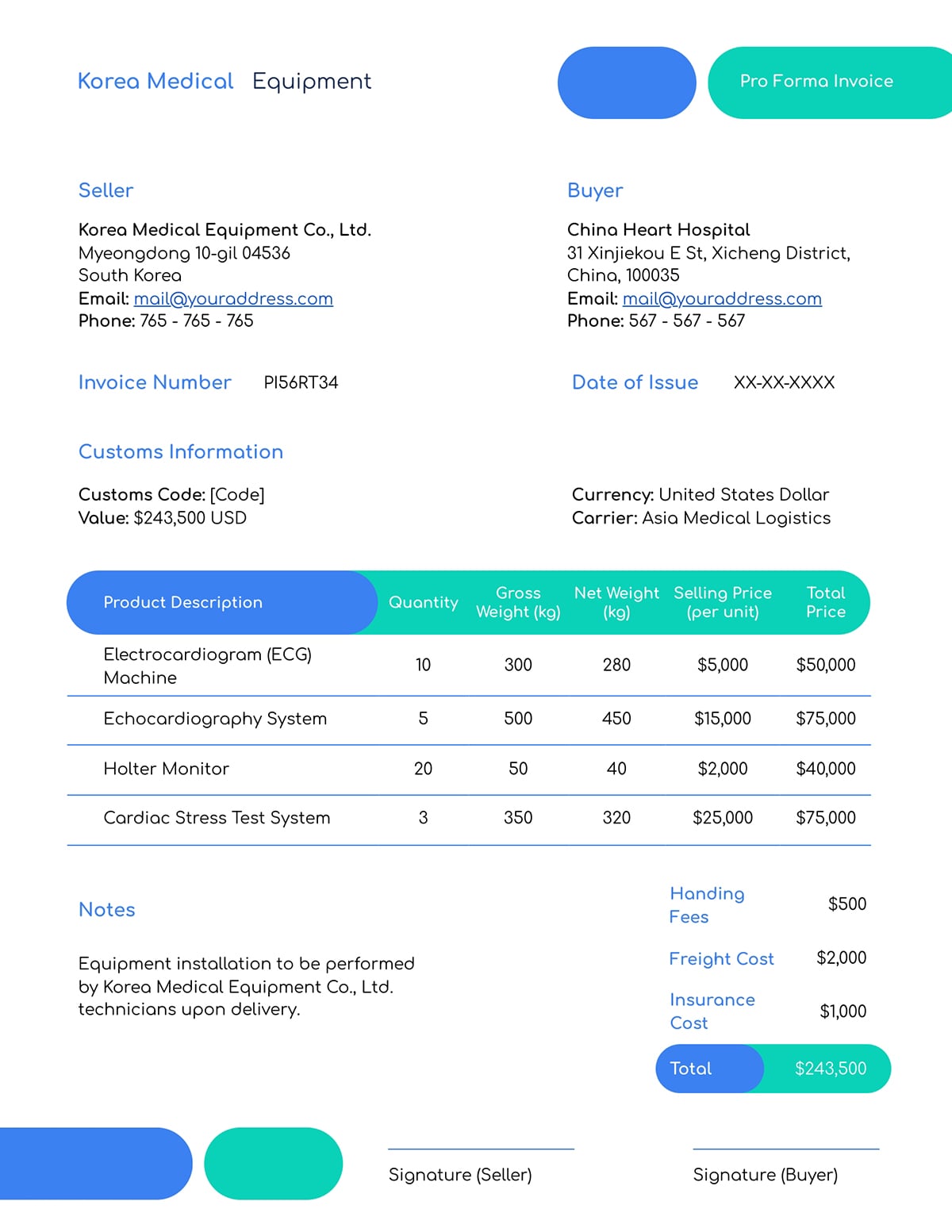

Using visually aligned invoices helps maintain your brand standards even during financial transactions. The healthcare pro forma invoice template below works well for insurance premium billing and payment documentation.

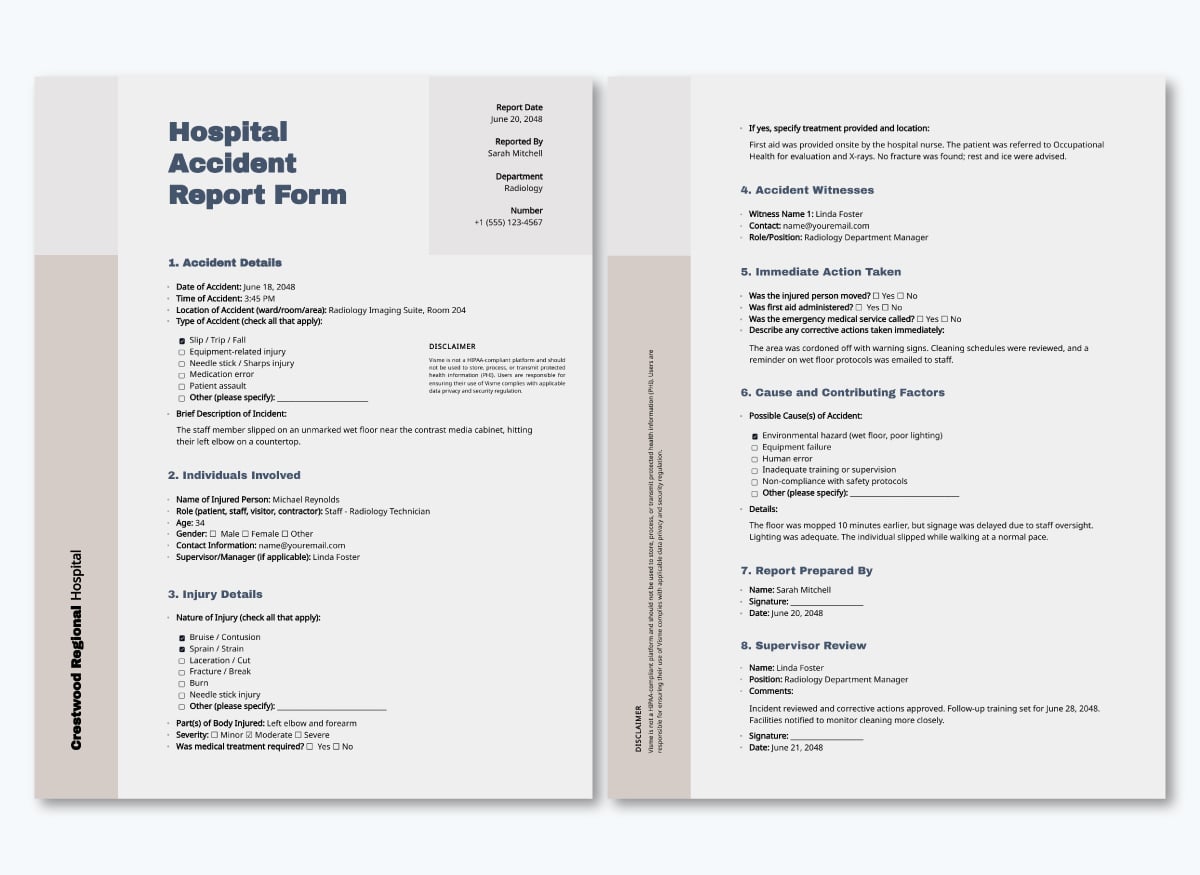

Branded accident and incident reports will help policyholders document claims events with all necessary details. For example, this hospital accident report template provides a structured format for collecting information, photos and witness statements that support the claims process.

The insurance marketing industry is adopting AI in several ways.

According to Taboola's Insurance Marketing Trends report, marketers are leveraging tools such as chatbots and AI agents to pre-qualify prospects on their landing pages. These tools also come in handy for scheduling agent consultations and creating marketing content for nurture sequences.

Likewise, the CDW 2025 State of AI in the Insurance Industry Report found that 78% of insurance companies plan to increase their AI investments, with top use cases including customer service automation, claims processing and personalized marketing communications.

AI is great and makes work easier, but it’s essential for insurance marketers to use the right data for it.

Because, as Errol Rodericks, product marketing leader at Denodo says,

“The organizations unable to unify their data will struggle to scale AI, resulting in higher costs, slower cycle times, and limited transformation capacity. Data readiness will become the new competitive frontier.”

Let’s look at how to market insurance products using AI while also staying compliant and safe.

The first and most important AI action you must take as an insurance organization is to make your AI private. Given that insurance is a highly regulated industry and that so much personal and confidential data is shared between policyholders and organizations, a generic browser-type AI poses significant risks.

When you input sensitive customer information, proprietary business strategies or confidential data into public AI tools, you're potentially exposing that information to the tool's training data or to other users. For insurance professionals handling personally identifiable information (PII), protected health information (PHI) and confidential financial data, this is a huge compliance risk.

Since insurance is one of the most heavily regulated industries, data breaches, privacy violations and improper handling of customer information can result in significant fines, license suspensions and irreparable reputation damage. You cannot afford to leak customer data through careless use of AI.

For independent agents and brokers, setting up private, local AI on your own machines is possible.

In the video below, AI expert Christopher Penn explains how to configure a private AI system that keeps your data secure and never sends it to external servers.

Bigger organizations, such as carriers or large agencies, will need more powerful enterprise solutions with stronger security controls.

According to McKinsey's research on generative AI in financial services, organizations that invest in secure AI infrastructure and governance see 40% fewer compliance incidents and significantly faster time-to-value from AI initiatives.

Consider these options:

You can generate insurance marketing content with AI using your in-house and completely isolated LLM system, or with privacy-protected AI APIs like the ones inside your Visme dashboard and editor.

Now, before you generate any content with AI, you need to train it on your brand.

According to Search Engine Land, organizations that invest time in training their AI see 3X better performance and significantly fewer revisions needed before publication.

You can train your AI on both text and visuals. With Visme, you can train the AI Designer to always stick to your visual brand guidelines, every time it generates new graphics, documents, presentations etc.

In the graphic below, you can see all the different channels AI can help create content for.

On the side, train your text-based AI with your brand voice guidelines, examples of your best content, ideal customer personas, user profiles and unique differentiators. Then, copy the final generated content from there and input it into Visme AI Designer. The AI will bring it all together and create a piece of content that aligns with your visual identity and utilizes your branded text.

Check the Visme section later in this guide for more detailed information on how our tool can help with your insurance marketing efforts, with or without AI.

The quality of AI output depends entirely on the quality of your prompts. Generic prompts produce generic results. Specific, well-structured prompts produce content that serves business goals.

Insurance marketing requires precision; you're communicating complex products, regulatory requirements and risk management strategies to audiences with varying levels of insurance knowledge.

Vague prompts won't cut it.

Even if your in-house LLM is trained, you still need to know how to write prompts properly so you can avoid extensive editing and revisions and speed up content production.

Getting good at prompt engineering requires that you h do it consistently and learn from mistakes.

To help you get started, I’ve created some pre-built prompt templates for common insurance marketing tasks.

AI Prompt to help with SEO/AEO and content marketing through a content hub.

Create a content hub strategy for "[main insurance topic]" targeting [audience] in [location]:

Pillar Page: One comprehensive guide title

Cluster Pages: 8-12 supporting subtopic titles covering:

- How-to guides for specific situations

- Cost/pricing topics

- Demographic-specific angles

- Common mistakes and solutions

- Local variations

- FAQ Pages: 5-7 question-based titles

- Comparison Pages: 3-5 "[A] vs [B]" titles

- Location Pages: 3-5 geographic variants

For each title provide:

- Primary keyword

- Search intent type

- Word count target

- Internal linking strategy back to pillar

Create a 5-email nurture sequence for [target audience] interested in [insurance type].

Each email should:

- Be 300-400 words long

- Have a compelling subject line

- Address one specific concern or question

- Provide actionable value (not just sales messaging)

- Include a soft CTA that moves them to the next stage

- Feel conversational and authentic, not salesy

Email 1 should welcome them and set expectations

Emails 2-4 should educate and build trust

Email 5 should present a clear next step or offer

AI models are trained on massive datasets sourced from the public internet, which means they've absorbed both accurate information and complete nonsense. Not only that, but generative AI also tends to “hallucinate” and make things up.

In insurance marketing, where trust is everything and regulations are strict, you can’t afford to publish or share AI-generated claims that are false, misleading or outdated. This is another reason your team must train the in-house LLM model with all detailed company information.

How to implement proper fact-checking:

Here's a simple fact-checking workflow you can follow every time.

According to McKinsey’s research on the future of AI in insurance, nearly all customer onboarding functions could soon be delivered by AI multi-agent systems that act as virtual coworkers. For instance, intake agents receive information and communicate with customers accordingly, a risk profiling agent can build comprehensive risk profiles, and a pricing agent can automatically price cases and suggest policy structuresl

There’s proven significant business impact. As Sean Vicente, US Sector Leader, Insurance, KPMG LLP, explains:

"When we introduce AI agents to take on data gathering and initial recommendations for use by critical business process owners, the impact can be dramatic. At scale, the ability to expedite tasks from hours to minutes—that's the kind of transformation that delivers real value and enhanced customer experiences."

Since AI Agents are customer-facing, you must be careful about how policyholders perceive them.

According to Deloitte’s report on the Implications of Generative AI for Insurance,

“Customer servicing and engagement within insurance companies requires a heightened sense of empathy and softer human interaction skills, especially during claims processing. Overemphasis on AI-driven automation may result in a lack of human touch, potentially leading to reduced customer satisfaction and loyalty.”

AI agents are used heavily in customer experience, but through the CX information they collect, they also support your marketing strategies.

They can handle tasks like Lead qualification, appointment scheduling, campaign performance optimization, lead nurturing through personalized follow-ups and social media engagement.

For example:

The strategies I covered in this guide are solid, proven approaches. But if you want to stand out and (pardon the clichè) cut through the noise, you sometimes have to try something different.

Here are some of the best insurance marketing ideas that fit outside the usual box.

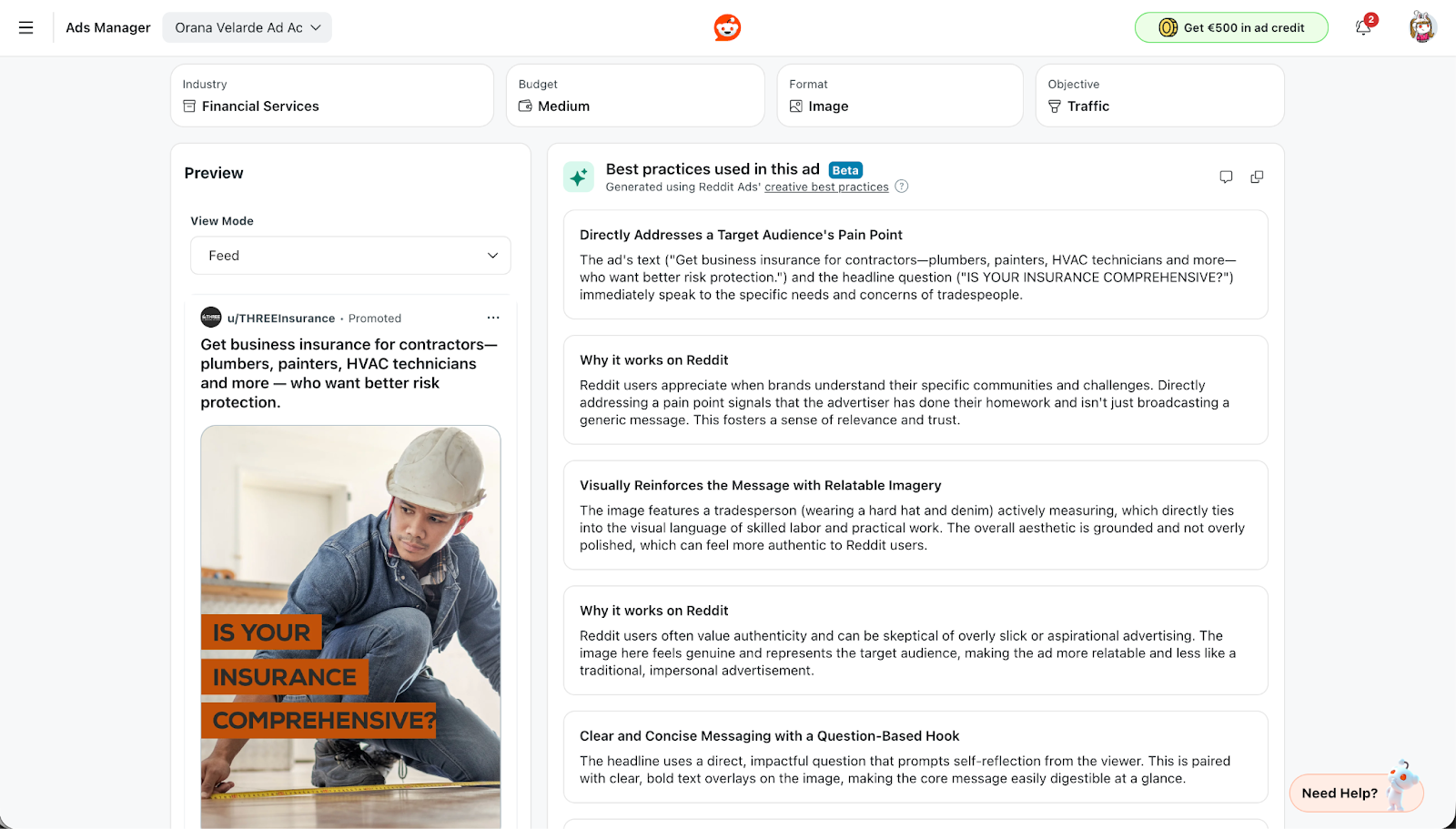

2026 is the time to pay attention to Reddit for your marketing strategies, and that includes insurance marketing, especially for B2B.

Just take a look at the data:

“Reddit provides something rare on the Internet,444 million people come here each week for authentic conversations they can’t find anywhere else, and increasingly, for engagement with brands, institutions and publishers.” says Steve Huffman, Reddit Co-Founder and CEO

Reddit is a long-term relationship-building platform. And for agents willing to invest time, it can become a steady source of warm leads who already trust your expertise.

The main trick is to be authentic and never pushy. Always read the subreddit rules before posting anything. In fact, many marketers never post anything; they just look around as a social listening activity to find out what their customers and potential clients are talking about.

Here are some tips to follow for a positive Reddit strategy

Reddit Ads has an inspiration page where you can see what other brands in the industry are doing with their ads. Furthermore, you can see the specific ad details and see what the Reddit experts suggest.

Emotional storytelling for insurance marketing builds trust by demonstrating your values through relatable scenarios. One of the best ways to achieve this is with TV commercials and social media videos.

Back in 2014, a Thai Life insurance company went viral for their tear-jerker commercial “Unsung Hero” ideated by their advertising agency Ogilvy & Mather. This wasn’t their first ad in this style, but it was surely the first to go viral.

This commercial shaped how insurance carriers marketed their services, relying more on emotion than on the product. Unsung Hero has become one of the most memorable advertisements of all time. If you don’t remember seeing it back in 2014, a quick search will prove just how loved that commercial is. Currently, the video has 125 million views on YouTube.

Check out the video below:

Thai Life has been using emotional storytelling in its marketing and advertising for decades. Check out their latest commercial, “The Boy at the Window.”

Thai Life’s approach to marketing and advertising, alongside their highly acclaimed customer service, has garnered a seven-year run as The Brand Of The Year according to the World Branding Awards.

You can use emotional storytelling at every level of insurance marketing. The above examples are at the carrier level and are typically very expensive to produce. But smaller agencies and independent brokers can also tap into this technique.

As we’ve already discussed, great insurance marketing educates. And what better way to do that than with video? You might already be using video on social media channels like Instagram and Facebook, but have you thought of making the leap to YouTube?

The benefits are supported by data. According to Wyzowl's 2025 Video Marketing Statistics report, 91% of marketers say they use as a marketing tool and 82% say video marketing has given them a good ROI.

YouTube channels work at every level, from carriers to brokers. StateFarm, for example, runs their own channel with over 250K subscribers.

Here are some ideas for videos you can create and share on your channel.

And here are some tips to follow for better results.

Check out this YouTube channel run by ABT insurance agency. They’re extremely active and post new videos regularly. Their thumbnails are eye catching and the topics they cover are super relevant to their target audience.

On average, employee networks have 10 times as many connections as a company has followers.

According to LinkedIn, the click-through rate on content is 2 times higher when shared by an employee than when shared by the company itself. While only 3% of employees share content about their company, those shares drive a 30% increase in total engagement.

For insurance specifically, this matters because trust drives decisions. When prospects research agencies, seeing multiple team members actively sharing expertise signals a knowledgeable, engaged organization. So, when a person from your company shares content about helping a client, it resonates more than your official post.

Insurance agencies are proving this works.

Comparion Insurance Agency, with 1,700 employees, has 40% of their workforce actively posting content on LinkedIn, ranking it #1 globally for employee advocacy among companies with 1,000+ employees in 2024.

Their president, Christopher Capone, regularly celebrates employee achievements, work anniversaries, team photos from events and charity initiatives.

Another Insurance organization, Humana, launched an employee advocacy program in 2015 that is still going strong. Because health insurance is heavily regulated, Humana was careful about what employees could say, but that didn't stop them from building a successful program that amplified their brand while staying compliant.

According to their 2024 Impact Report, 88% of Humana employees believe their work is meaningful, and 80% would recommend Humana as a great place to work. The 2026 Employee Advocacy Benchmark Report highlights that the most active departments in employee advocacy programs are sales and marketing. This proves how impactful this strategy can be for insurance marketing.

When employees share content that reflects who they are and what they actually do, people relate to them. Here are some tips to help you get started.

The right tool stack will make a big difference in how well your insurance marketing performs like a well-oiled machine. That said, insurance marketing demands specialized solutions that handle compliance, manage complex customer data and deliver personalized experiences at scale. So, the combination you put together is highly important.

Here’s a list I compiled of the highest-rated business tools you can use in your favorite combination to plan, strategize, and manage your insurance marketing efforts.

| Tool | Who it’s for | Core Use | Key Features | Security & Compliance | Pricing | G2 Rating |

|---|---|---|---|---|---|---|

| Salesforce | Enterprise insurance operations, multi-location agencies, carriers | CRM | Lead scoring, automated journeys, policy lifecycle marketing, ROI tracking, AI agents | SOC 2 Type II, HIPAA-ready, role-based permissions | No free plan; paid plans from $325/user/month | 4.4/5 (93K+ reviews) |

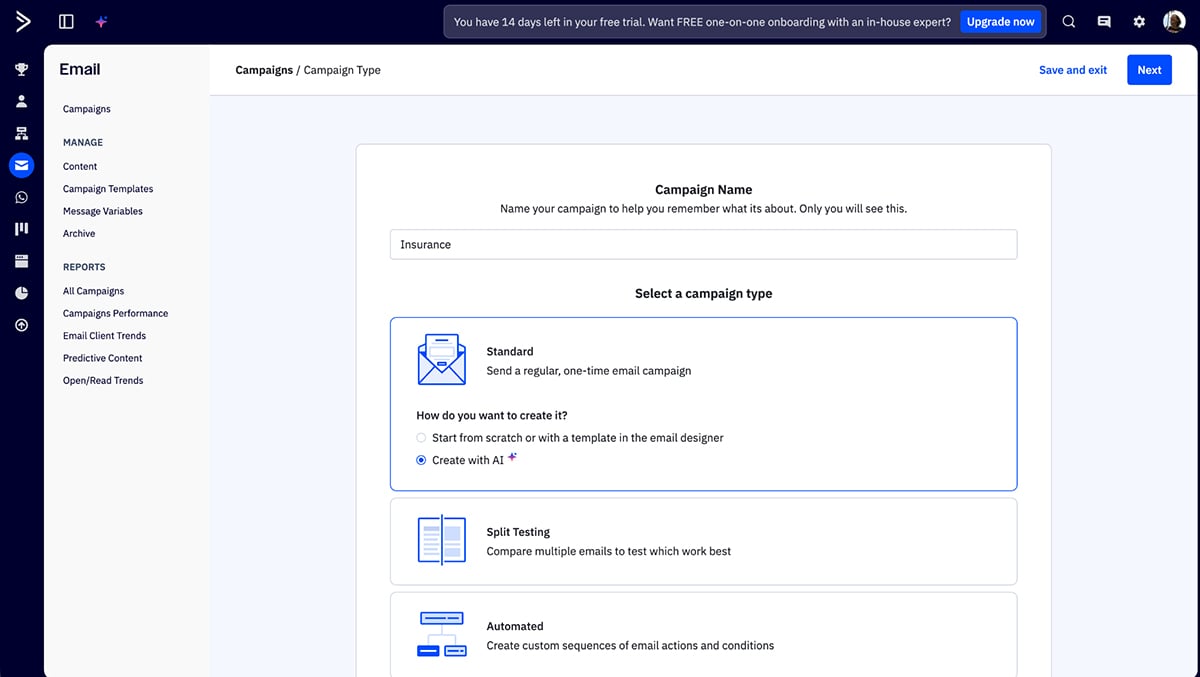

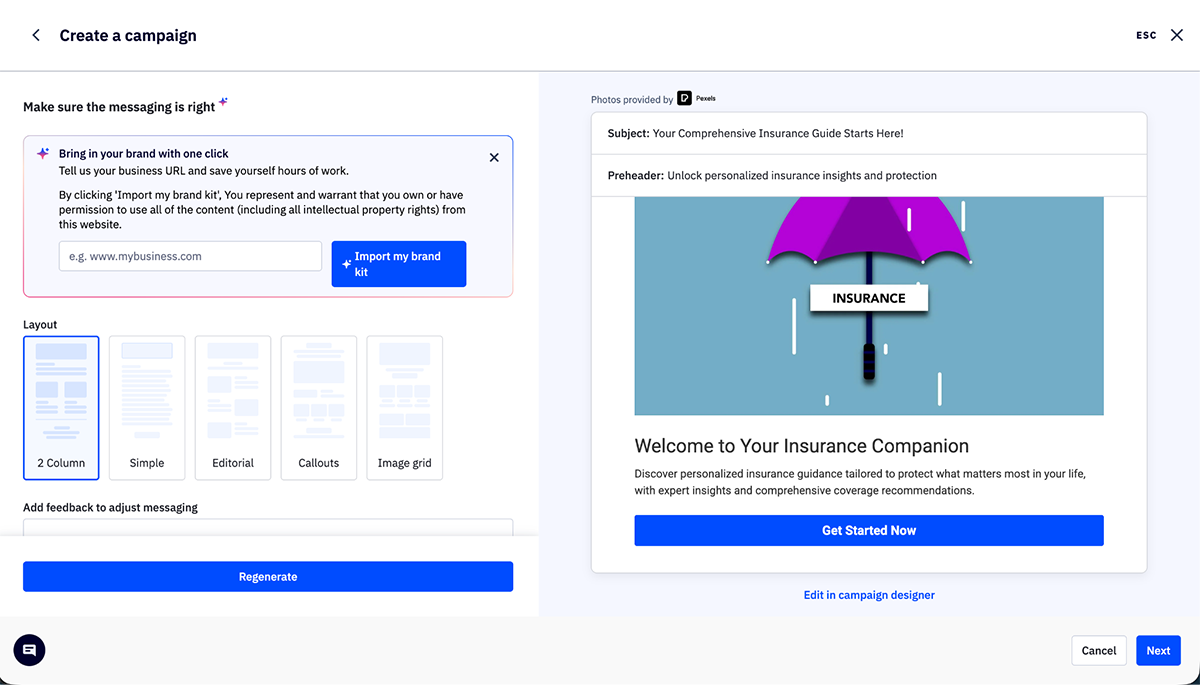

| ActiveCampaign | Independent agents and small-to-midsize brokerages | Email marketing & automation | Visual automation builder, CRM integration, behavioral triggers, segmentation | GDPR compliant, SSL certified, data encryption | Free trial; paid plans from $15/month | 4.5/5 (14K+ reviews) |

| Visme | Insurance marketers and teams creating compliant visual content | Visual content creation | Brand compliance, version control, thousands of templates, AI design tools, interactive content | SSO & 2FA, role-based access, approval workflows, password-protected projects, search engine opt-out | Free plan available; paid plans from $12.25/month | 4.5/5 (450+ reviews) |

| AdCreative.ai | Agencies and carriers running digital ad campaigns | AI ad generation | AI-powered ad creation, A/B testing, multi-format output, performance prediction | GDPR compliant, secure data handling | Free trial; paid plans from $29/month | 4.3/5 (900+ reviews) |

| Vista Social | Agents and agencies managing multiple social accounts | Social media management & scheduling | Multi-platform scheduling, content calendar, analytics, team collaboration | Secure API connections, data encryption | Free plan available; paid plans from $15/month | 4.8/5 (1,000+ reviews) |

| Sprout Social Influencer Marketing | Insurance carriers and large agencies | Influencer marketing management | Creator discovery, campaign management, performance tracking, ROI analytics | Enterprise-grade hosting, compliance reporting, data encryption | Custom pricing | 4.3/5 (300+ reviews) |

| Ahrefs | Insurance-focused content marketers and SEO specialists | SEO analysis & research | Keyword research, competitor analysis, backlink tracking, content gap analysis | Secure access controls, data encryption | Paid plans from $99/month | 4.5/5 (600+ reviews) |

G2 rating: 4.4/5 (93K+ Reviews)

Best for insurance marketing teams at medium to large-sized agencies, brokerages and carriers.

The Salesforce Financial Services Cloud combines CRM and marketing automation specifically for finance teams, including those in the insurance industry. Marketing teams can track every prospect interaction in one place: website visits, email opens, quote requests and agent calls. Then, they can use that data to send perfectly timed marketing messages that will move prospects closer to conversion.

Likewise, the data helps nurture existing clients for cross-selling, up-selling and ongoing communication to maintain their business.

Pros

Cons

G2 rating: 4.5/5 (14K+ reviews)

Best for independent agents and small- to midsize brokerages.

ActiveCampaign hits a sweet spot between a simple email tool and an enterprise marketing platform. It’s powerful enough to run complex, behavior-triggered email sequences while also being intuitive and easy to use. A single marketing person or even an agent doing their own marketing can manage this tool effectively.

For insurance marketing specifically, ActiveCampaign shines in its ability to segment audiences by policy type, coverage amount and engagement behavior, then deliver personalized email nurture sequences. Using the visual automation builder, your marketing team can easily map our complex customer journeys without the need for professional technical skills.

Additionally, aside from emails, you also have the option to create personalized WhatsApp campaigns from inside the same platform.

ActiveCampaign doesn’t offer the security and compliance features that Salesforce does, for example, but it does meet the security needs of most independent agents and small agencies.

Pros

Cons

Free trial available. Options to choose between only email, only Whatsapp or both.

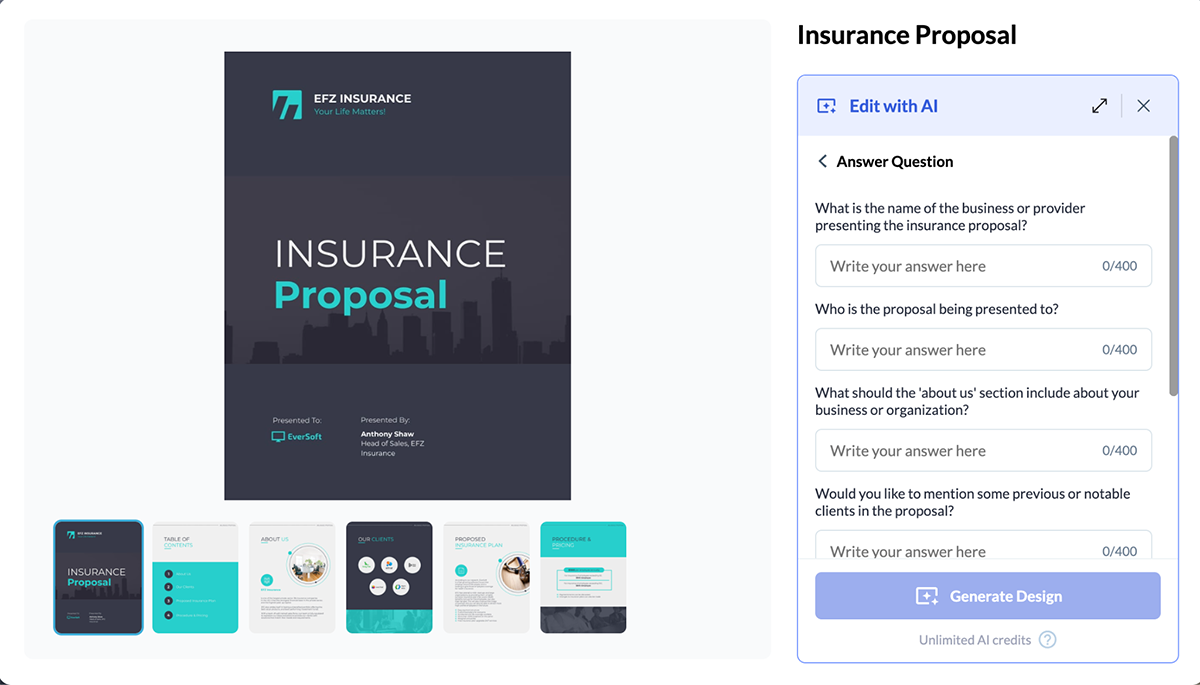

G2 rating: 4.5/5 (450+ reviews)

Good for independent agents and brokers as well as medium, large and enterprise-level agencies.

Content creation is an essential element at all levels of insurance marketing. Visme, as an all-in-one content authoring platform, is the ideal option for creating all your marketing content. You’ll find it easy to design both internal and external marketing materials that are all branded and aligned with your visual identity.

The platform combines design tools, templates and brand management in one place. Plus, it offers integrations with tools like Salesforce and HubSpot to make the workflow easy and seamless.

“The great thing about Visme is that it’s instant, you make an update, and it’s live, and it’s updated everywhere! That’s one of my favorite features of the tool.” Kimberly Barrett, Wellbeing Consultant at Ameritas, shared with us about here experience with Visme.

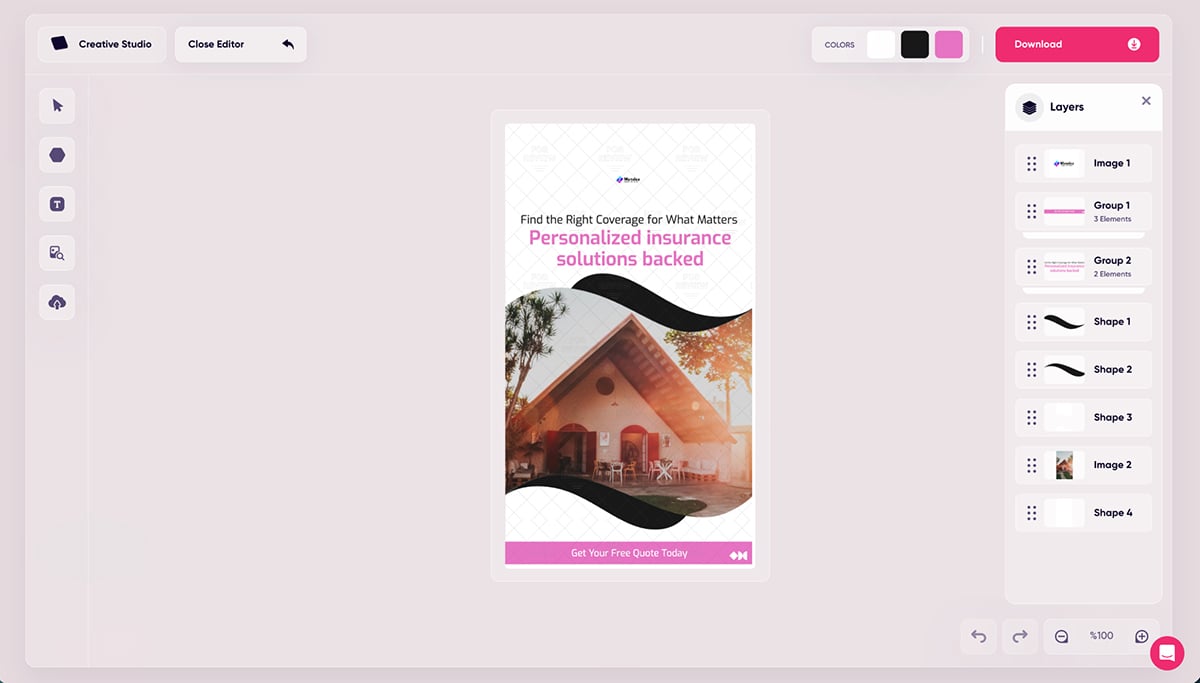

Below is a screenshot of one of our insurance-based templates with the Edit with AI option opened and ready to go.

Pros

Cons

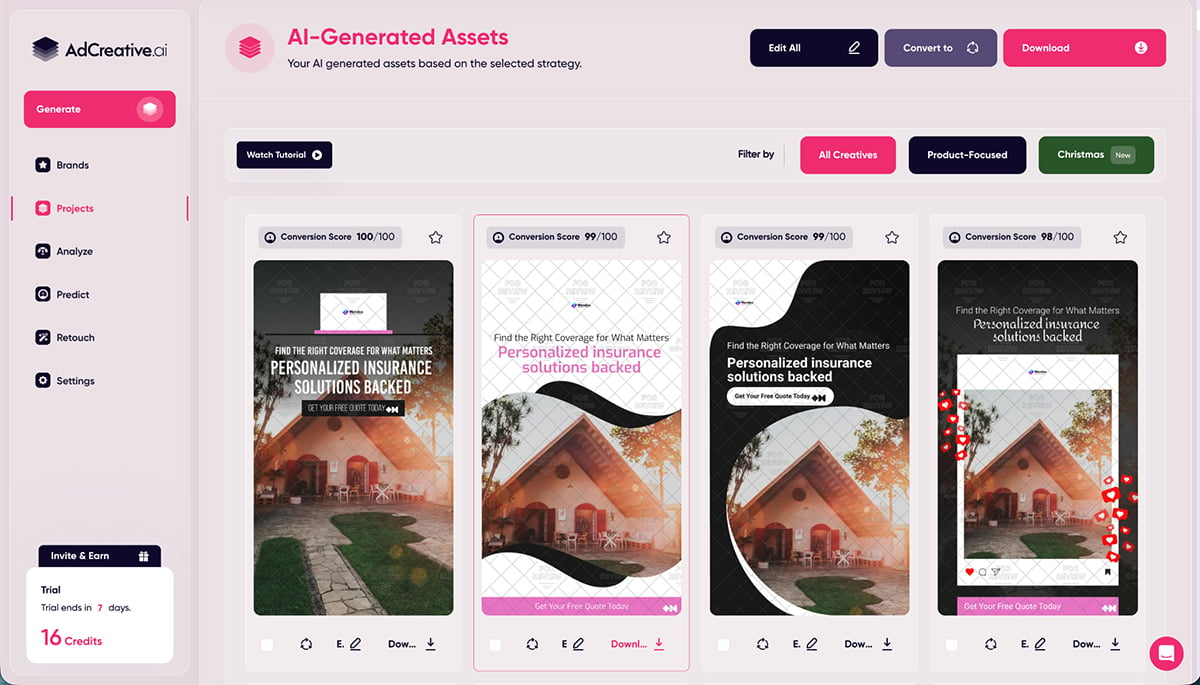

G2 rating: 4.3/5 (900+ reviews)

Best for insurance agencies and carriers running paid digital advertising campaigns.

AdCreative.ai is a design platform that uses artificial intelligence to generate high-performing ad creatives specifically optimized for conversions. This means you can produce dozens of professional ad variations for several channels in minutes.

The tool analyzes your brand assets, industry competitors and top-performing ads in your industry to generate creatives that are statistically more likely to convert.

Pros

Cons

G2 rating: 4.8/5 (1000+ Reviews)

Best for independent agents and agencies managing multiple social accounts across platforms.

Vista Social is a social media management platform with robust features, integrations and capabilities for marketing insurance on social media. The tools make it easy to stay on brand and compliant thanks to customizable approval processes.

The platform connects to countless channels, including social media, business intelligence, help desks, app stores, rating sites and workflows. All combined, you can take care of post scheduling, social listening, content analytics, employee advocacy and team collaboration all from within the same interface.

Pros

Cons

G2 rating: 4.3/5 (300+ Reviews)

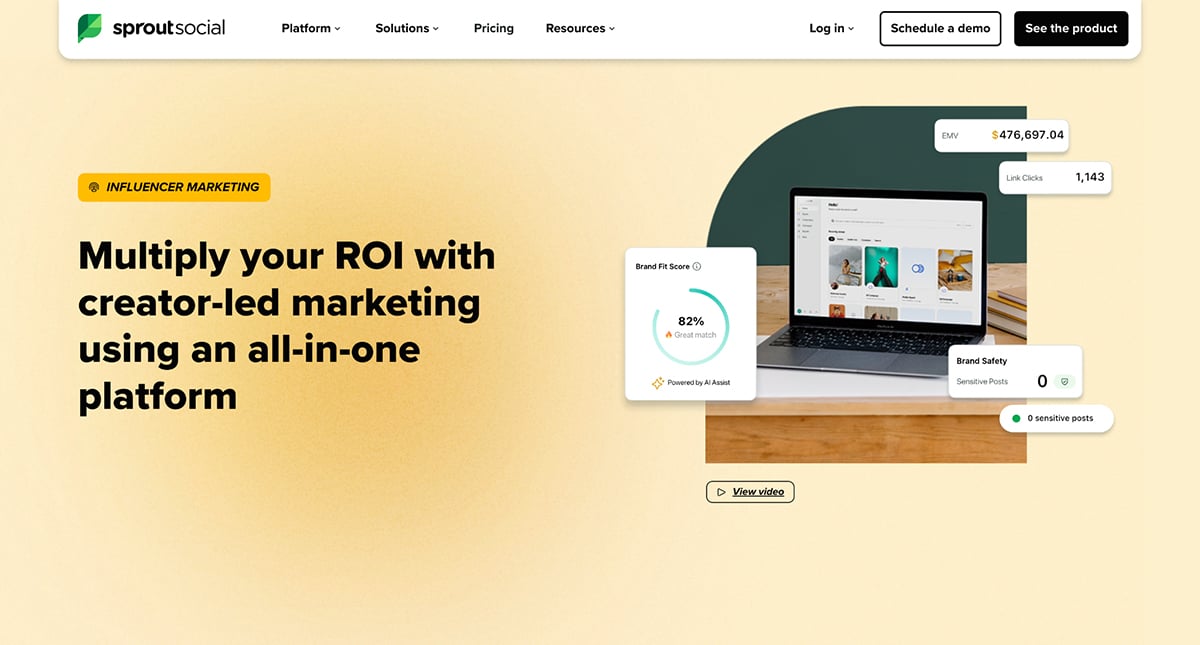

Best for insurance carriers and larger agencies running influencer marketing campaigns

Sprout Social is another social media management platform, but what sets it apart is its influencer marketing arm. Whether you're looking for financial advisors to promote life insurance, parenting influencers to discuss family protection or business coaches to highlight commercial coverage, Sprout Social will help you identify influencers whose audiences match your target demographics.

Then, you can manage relationships with them from within the platform itself. You don’t need to get a main Sprout Social account to use the influencer marketing feature, but it might help if you want to limit the number of tools you’re using.

Cons

Cons

Pricing for the Influencer platform is available upon request after scheduling a demo.

G2 rating: 4.5/5 (600+ Reviews)

Best for insurance-focused marketers and SEO specialists at all insurance marketing levels.

Ahrefs is the industry-leading SEO platform that helps marketers understand what prospects are searching for, identify content opportunities and track search rankings. For insurance professionals investing in content marketing and SEO, Ahrefs provides the competitive intelligence needed to outrank competitors and capture high-intent search traffic.

The platform excels at uncovering the exact keywords prospects use when researching insurance topics, revealing which content ranks in search results and showing gaps in your SEO strategy that competitors are capitalizing on. Like most professional tools, Ahrefs has been adding AI-powered features for various purposes and will continue to do so.

Proa

Cons

Yes. Insurance companies need marketing for several reasons. Mainly to:

These are four core strategies that apply to all types of marketing. Most businesses combine two or more of them for the best results.

The 4Ps of insurance marketing are:

To sell insurance to customers effectively, you must embrace a trust-based consultative approach that builds awareness. This will position your brand as an advisor rather than a simple sales machine. These are the strategies to follow for selling insurance:

Sources: https://www.quora.com/How-do-I-sell-life-insurance-to-a-customer

https://www.youtube.com/watch?v=tK6wPNi4uPM

https://ritterim.com/blog/how-agents-can-use-stories-to-sell-insurance/#social-media-ebook

Yes, HubSpot works well for insurance agencies, agents and brokers who focus on digital marketing and lead nurturing. Its strengths include marketing automation, content management, an integrated CRM and email marketing tools. HubSpot also offers enterprise-grade security and compliance features that meet insurance industry regulatory requirements. The platform protects sensitive customer information with data protection standards and audit trails.

There are countless insurance marketing campaigns that have delivered positive results in ROI and awareness. These four, in particular, succeeded through memorable characters, technological innovation, and messaging that made insurance relatable rather than technical. They were part of a roundup by Insurance Business Mag on successful campaigns.

AI is making waves in all fields of marketing, including insurance marketing. But successful AI implementation still requires human oversight for fact-checking, brand training, privacy protection and compliance.

These are some of the tasks AI is powering in the industry:

As an insurance professional, your work is definitely cut out for you. But thankfully, it doesn’t need to get overwhelming.

The strategies we've covered, from SEO and content marketing to emotional storytelling and influencer marketing, all share one common thread: they prioritize the customer's needs, questions and concerns above everything else.

Hopefully, with the help of this playbook, you feel more confident about what you can achieve and how.

Remember, you don't need a massive marketing budget or a full team to make a real impact. What you need is clarity about who you serve, consistency in showing up for them and commitment to being a trusted resource that inspires trust.

And what matters most: consistency.

You don't have to do everything at once. Start with one or two strategies that align with your strengths and your audience's needs. Maybe that's launching an educational blog series, testing Reddit marketing in relevant communities or implementing that email nurture sequence you've been planning.

Then, build from there. Add new tactics as you master each one. Track what's working. Double down on what resonates with your audience.

Ready to create insurance marketing materials that actually convert? Visme gives you everything you need to design professional, on-brand content; from interactive infographics and policy proposals to social media graphics and sales battlecards.

Connect with sales to discover how Visme empowers your insurance team.

Design visual brand experiences for your business whether you are a seasoned designer or a total novice.

Try Visme for free