How to Make an Invoice: Step-by-Step Guide (& Free Templates)

If there's one thing that makes business owners stay up late at night, it's late payments. According to the latest research, late payments cost small businesses around $3 trillion a year!

In fact, 89% of small business owners believe late payments hurt long term business growth.

Learning how to make an invoice properly not only helps you get paid on time, but it also helps you keep accurate records of all your financial transactions.

If you’ve recently started a new business and aren’t sure how to create an invoice from scratch, this post will help you get started with invoicing on the right foot.

We've also added customizable templates, tools, best practices and tips throughout the article to help you create a professional invoice for your own business.

If you want to skip the tutorial and start creating an invoice, sign up for our free invoice maker (with templates) and get started right away.

How to Make an Invoice in 8 Easy Steps

- What is an Invoice?

- The Essential Elements of an Invoice [Infographic]

- How to Make an Invoice (Step-by-Step)

- 11 Invoice Templates to Help You Get Started

- Invoice Best Practices & Mistakes to Avoid

- Best Tools to Send Invoices

Quick Read

- An invoice is a document used to request payment from a client for goods or services provided. It serves as a detailed record of what was purchased, when it was purchased, the cost and the agreed-upon payment terms.

- The following are the essential elements that should be in an invoice: Invoice number, products or services, total amount due, key dates, payment terms and applicable taxes /VAT details.

- To create an invoice, start with an invoice template, add the invoice ID and company details, list the products or services provided, add the total amount due, enter key dates, mention the payment terms, customize the design, then download or share.

- Visme offers a wide range of features and professionally designed invoice templates to make invoicing a breeze.

- Sign up now to get started with Visme’s invoice maker.

What Is an Invoice

An invoice is a document issued to request payment of goods and services from a client. It contains a clear record of what was purchased, when it was purchased, the cost of the purchase and the payment terms.

Invoice vs Purchase Order vs Receipt

A receipt is a document that proves that payment for goods or services has been received, whereas an invoice is a document that requests payment for goods or services already provided.

A purchase order, on the other hand, is a document created by the buyer to formally request goods or services from a seller before any payment is made.

Within a sales process, purchase orders are used to initiate the order, invoices are used to request payment, and receipts confirm that the payment has been made.

Here’s a table that summarizes the differences between these three:

| Invoice | Purchase Order | Receipt | |

| Purpose | To request payment for goods or services that have been delivered or completed. | To formally request goods or services from a supplier. | To confirm that payment has been received. |

| Content | Lists the items or services delivered, total amount due, payment terms, due date and invoice number. | Includes details such as items ordered, quantity, agreed price, delivery date and terms of purchase. | Highlights the amount paid, date of payment, items or services paid for and payment method. |

| Timing | Sent after or before goods or services have been provided. | Created and sent before the goods or services are delivered. | Issued after payment is made. |

| How it’s used | Issued by the seller to the buyer as a formal request for payment. It helps track outstanding payments and manage cash flow. | Issued by the buyer to authorize a purchase. Once accepted, it becomes a legally binding agreement between buyer and seller. | Provided by the seller to the buyer as proof of payment. It is often used for recordkeeping, reimbursements, or tax purposes. |

The Essential Elements of an Invoice [Infographic]

Before we get into the step-by-step guide of creating an invoice, it’s important to know the basic elements that make up an invoice.

We’ve created this infographic to help you visually understand these essential elements.

Read a detailed explanation of each element and when to add it to your invoice throughout our step-by-step tutorial below.

How to Make an Invoice

Jump to:

- Step #1: Start With an Invoice Template

- Step #2: Add the Invoice ID and Company Details

- Step #3: List the Products or Services Provided

- Step #4: Add the Total Amount Due

- Step #5: Enter Key Dates

- Step #6: Mention the Payment Terms

- Step #7: Customize Your Invoice Design

- Step #8: Download or Share Your Invoice

- Bonus: Make Your Invoice Interactive

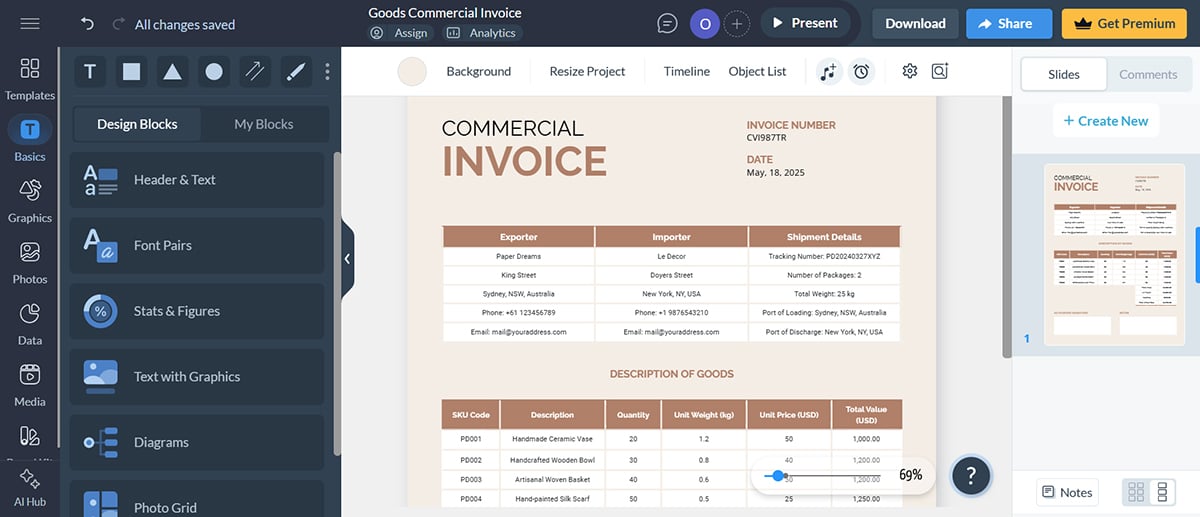

Step #1: Start With an Invoice Template

If this is your first time creating an invoice, it’s best to start with a professional invoice template.

An invoice template comes with pre-made headers, sections, formatting and even placeholder content. So, all you need to do is replace the existing text with your own information.

Invoice Templates

Using an invoice template can save you valuable time and effort. You don’t need to worry about designing a layout from scratch, or think about where to place each section. Instead, you can invest that time in more important things — like growing your business.

Plus, if your invoice template comes with placeholder content, you’re less likely to miss any details, like adding an invoice ID or your business address.

Jump ahead to view our collection of invoice templates.

Pro-tip: If you’re using an invoice maker like Visme, you can customize the design of your invoice template to match your company’s branding. Upload your logo, brand fonts and colors, and even save your invoice as a custom template to use later.

Step #2: Add the Invoice ID and Company Details

The next step of invoicing is to address the two basic parts of your invoice:

- A unique invoice ID to identify your invoice

- Company details for both you and your client

Let’s take a look at each one in detail.

Invoice ID

An invoice ID or invoice number is a unique identification number that helps you keep track of your invoices. This usually goes at the top of your invoice, like this:

You can choose to go with an increasing numbering system to mark your invoices, such as 0001, 0002, 0003 and so on. Or, you can use a combination of numbers and letters, such as A0021, B4022, H2213 and so on.

Using letters in your unique invoice number is helpful if you have multiple clients as you can simply assign a letter to each individual client. This makes it easier to keep track of and distinguish your invoices.

For example, all invoice IDs starting with the letter A are those billed to Client A, and all invoice IDs starting with the letter B are those billed to Client B.

Business owners can also use number-letter combos to distinguish between invoice types. For example, invoices with the letter T could indicate tax invoices, and invoices with the letter S could denote standard invoices.

Company Details

Another basic element to add to your invoices is company details.

This includes the name, address and contact information (phone numbers and email addresses) of both your own business and your client’s.

Make sure you also include the name of the contact person you’re sending the invoice to. You can add this information at top or bottom of your invoice, depending on your design.

Double-check all of this information before finalizing your invoice — especially the details of your client. Any incorrect detail can lead to delays in payment, such as if your invoice is delivered to the wrong address.

Step #3: List the Products or Services Provided

Once you’ve added the basic details to your invoice, it’s time to add information about the products or services provided to your client.

The best way to list the items sold in your invoice is in the form of a table. This helps you present the information in an organized way so your client is less likely to miss any detail.

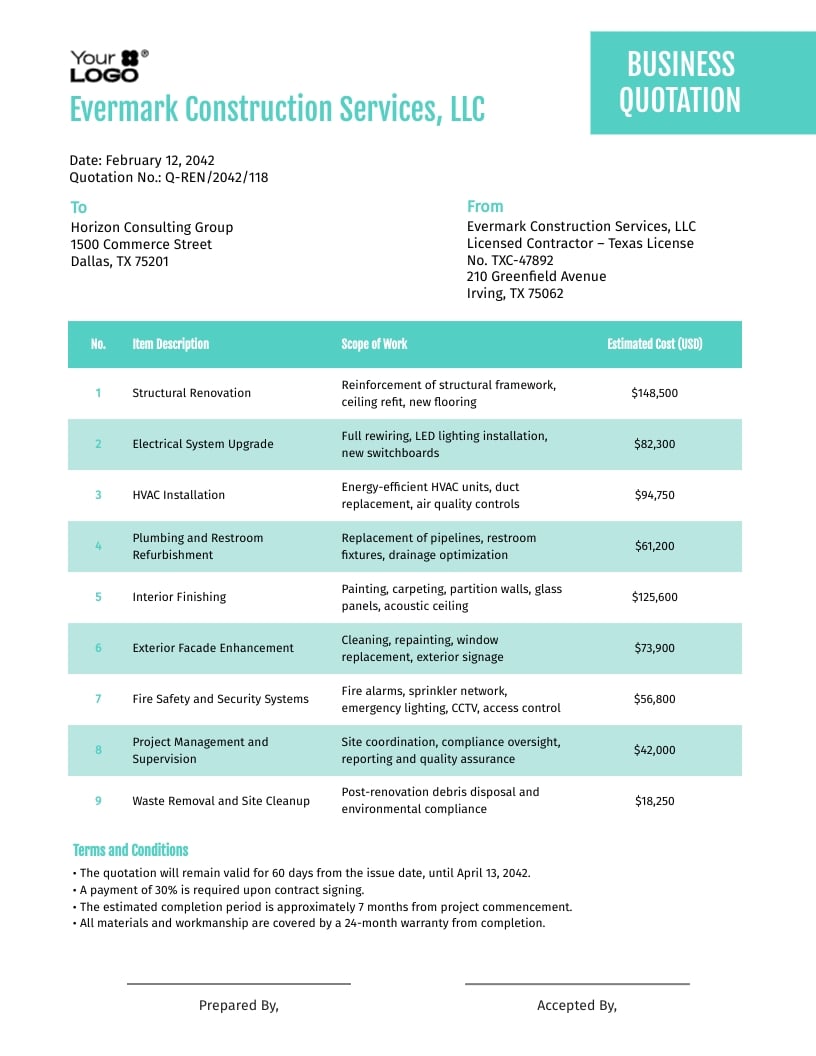

Here’s an example of an itemized table in an invoice.

In your table, you may include some or all of the details below:

- Serial number

- Product name

- Product quantity

- Product description

- Product price

- Hourly/day rate (if applicable)

Step #4: Add the Total Amount Due

The next step to creating your invoice is to add the total amount due.

Mentioning this amount at the end of your itemized list of products and services makes it easier for clients to quickly see how much they’re expected to pay in total and for what.

You may also want to highlight this number by using a bold or different-colored font. If your client is too busy to read the entire breakdown of costs, they can just look at the total amount due and make the payment.

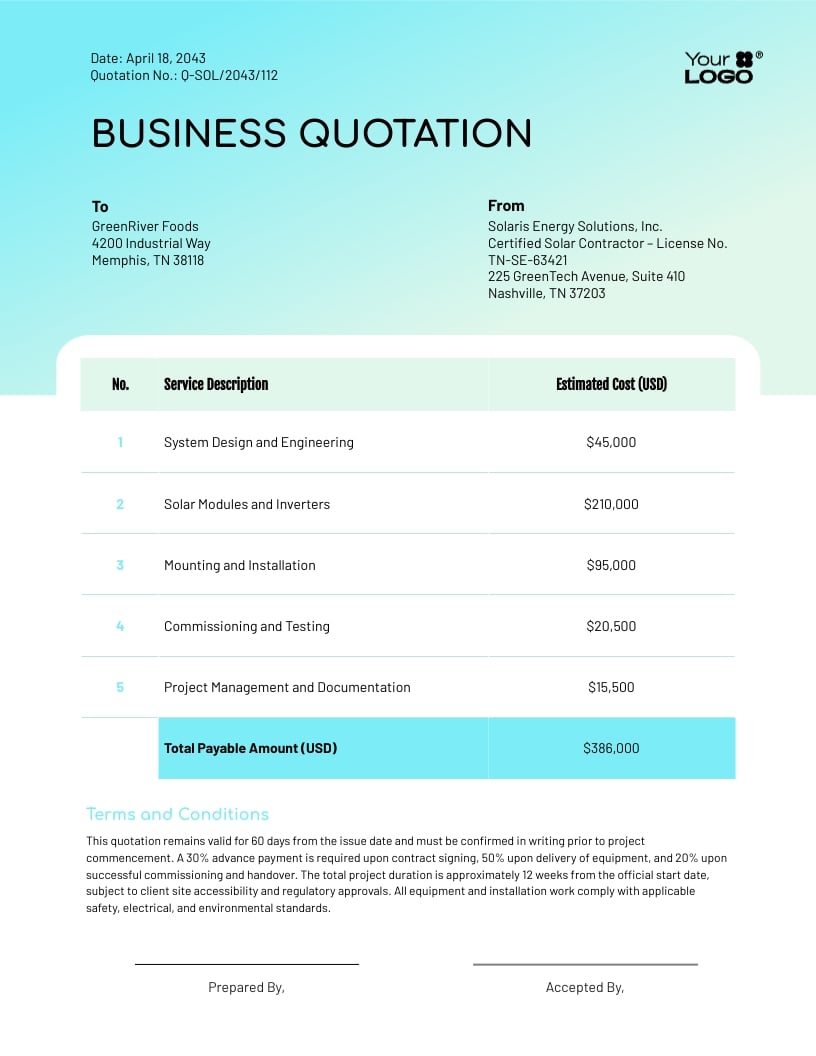

Here’s an example of an invoice design that uses a bold font for the grand total.

In many cases, all you have to do is to add up the individual costs of the items, and mention the total sum at the end.

But sometimes, you may need to take any discounts, prepayments and taxes into consideration before calculating the total amount.

In that case, you can simply add another row after the subtotal, and mention any additions or subtractions there.

Then, you can calculate the total amount and display it at the end, like this:

Step #5: Enter Key Dates

Any invoice is incomplete without dates.

There are three types of dates you can add to your invoice, depending on the nature of your business, your understanding with the client and your personal preferences:

- Invoice date: This is the date you created and sent the invoice to your client. The invoice date helps both you and your client keep track of when the invoice was issued.

- Supply date: This is the date on which you provided your products or services to the client. The supply date can vary for each product or service mentioned in your invoice.

- Due date: This is the last date for your client to make their payment. If the payment is made after this date, it’s considered to be a late payment, and may be subject to a penalty or late fee.

Adding exact dates for the above, especially the invoice due date, can help prevent any delays in payment. These dates are also useful for keeping an accurate record of all your invoices, including when they were sent, and when you provided the products or services.

Step #6: Mention the Payment Terms

Lastly, you should always mention any pre-decided payment terms between you and your client. This includes the payment methods to be used, as well as any discounts or penalties that may be applicable on the invoice amount.

When it comes to invoice payment methods, we recommend you add more than one method to make it easier for clients to pay you on time.

Here are some payment methods you may want to offer:

- Cash

- PayPal

- Bank transfer

- Cheques

- Debit card

- Credit card

- Wise

- Payoneer

To incentivize your clients to pay you on time, you may also want to offer them discounts on early payments. In a similar vein, you can charge them a penalty for missing the due date.

Whatever your payment terms are, make sure you mention them in your invoice in a dedicated section at the bottom to avoid any misunderstandings and disputes in the future.

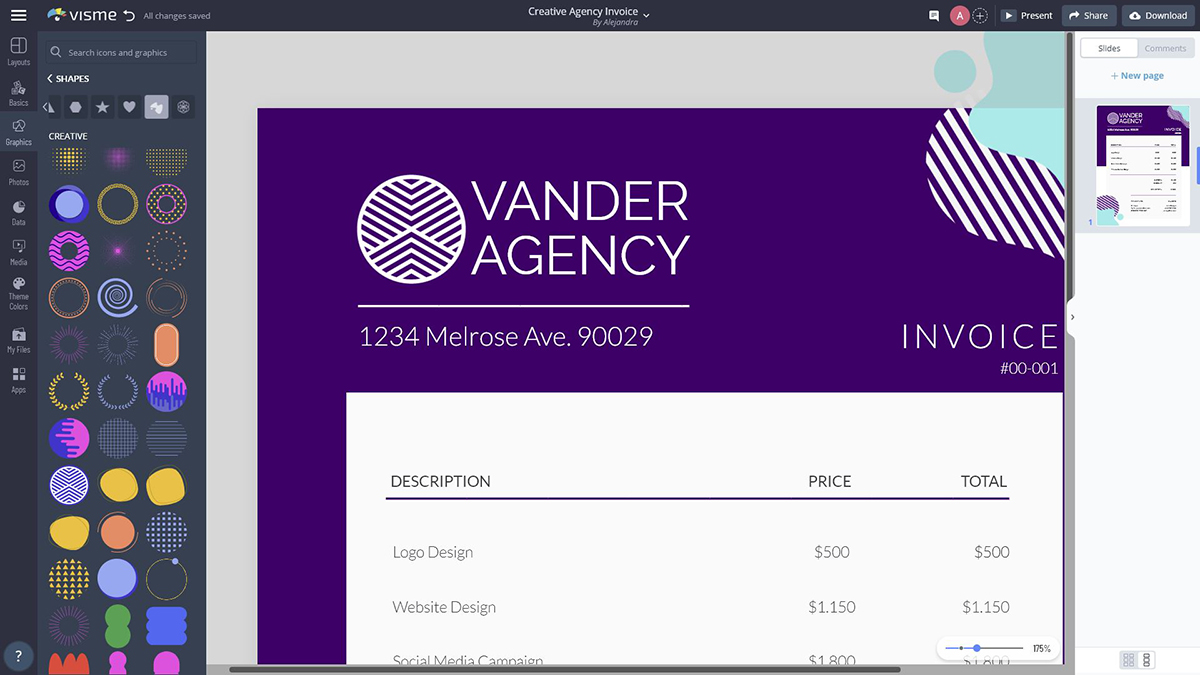

Step #7: Customize Your Invoice Design

Anyone can whip up a plain-looking invoice in Microsoft Word or Excel, but if you want to go the extra mile and turn your invoice into a marketing tool, you need to get creative.

A great-looking invoice can make your business look professional. Better yet, if you add your company logo and brand colors to it, it can help you generate brand awareness and reinforce your brand identity in the minds of your clients.

If you’re using Visme to make your invoice, you can easily customize the template design so it’s aligned with your brand.

Browse through dozens of pre-made invoice templates, customize text, colors, fonts, tables and everything else, upload your logo, brand colors and fonts, and more.

Another great idea to enhance your invoice design is to add a border.

Borders can help frame your invoice and make it look clean and professional. This doesn’t need to be a fancy border — the invoice template above uses a simple duo-tone border to stand out.

With Visme, you can also save your unique invoice design as a custom template. That means if you have multiple clients or bill one client regularly, you can simply go in and edit your custom template to save time.

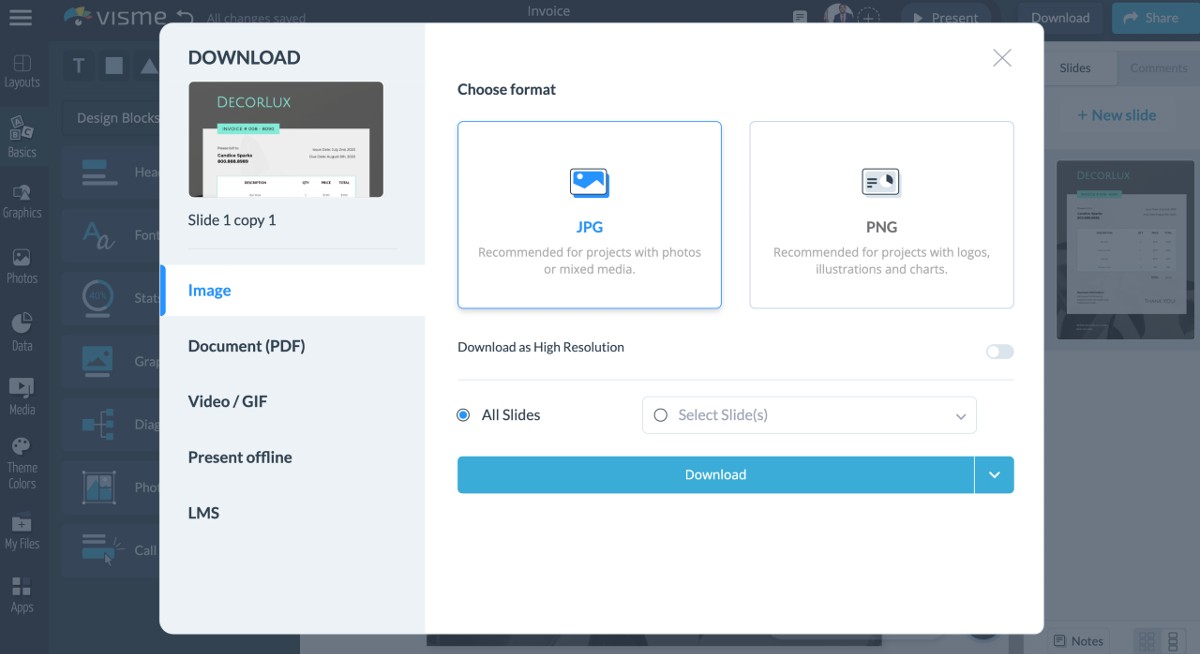

Step #8: Download or Share Your Invoice

Finally, it’s time to download your invoice and share it with your client.

There are several ways to share your invoice. If you prefer dealing with hard copies, you can save your PDF invoice and get it printed.

Or, you can share the file via email with your client if you find soft copies easier to work with.

Visme lets you save your invoice in various formats, including PNG, JPG and PDF. You can also skip the downloading process and share your invoice directly with a link.

That’s it. You’re ready to create your invoice and start billing your clients.

If you want to accelerate the process of invoicing, we’ve put together a bunch of invoice templates for you in the next section.

Bonus: Make Your Invoice Interactive

If you’re creating an online invoice, you can make it interactive by adding links to it. This is not just innovative, but it’s also a great way to prompt clients to pay you on time.

For example, you can add a “Make Payment” button to your invoice, and link it to PayPal or any other payment page to make it easier for clients to pay on the spot.

If you’re making your invoice in Visme, you can easily make your invoices interactive by adding links to various elements.

Share your interactive invoice online with a link, or download it in HTML5 format (offline web page) to preserve interactivity. You can also add hover effects, pop-ups, animations and more to make an extra-creative invoice.

11 Invoice Templates to Help You Get Started

Creating invoices from scratch can be a chore, especially if you’re short on time.

Thankfully, there are plenty of sample invoice templates available online to help you skip the hassle and get started quickly.

We’ve handpicked 11 invoice templates for various use cases below.

Each template is fully customizable in Visme and comes built-in with placeholder content so you don’t miss any important details like company addresses and payment terms.

1. Simple Invoice Template

This simple invoice template is free to use, and perfect for all kinds of businesses — from retail and ecommerce to contractors, consultants and manufacturing companies.

The big, centralized header at the top draws focus to your company name or logo, and the total amount due at the end also has a space for you to add any taxes, discounts or surcharges.

You can easily change the color scheme of this free invoice template by choosing from one of our one-click color themes. Or, change the color of each element separately.

2. Service Invoice Template

This clean and professional invoice template is designed with service businesses in mind, but you can use it for any other purpose.

The solid-colored border frames the invoice to make the information in the center stand out and look organized. You can change the color of the border to your primary brand color, and add your own business logo at the top.

3. Construction Invoice Template

This invoice template is designed for contractors, home repair businesses and any company operating in the construction, remodeling or real estate industry.

However, you can easily use it for any other purpose or business by editing the text, swapping the logo for your own, changing the color scheme and fonts, and dragging and dropping the elements as needed.

4. Consulting Invoice Template

This professional invoicing template is made especially for consultants, accountants and other business services, but it can easily be used for any other purpose.

The yellow header and total amount due is designed to stand out against the gray color scheme, but if you want to change the colors to fit your brand, you can quickly do so in Visme’s invoice generator.

5. Freelance Invoice Template

This invoice template is a great fit for freelancers, small businesses and consultants. It’s simple, straightforward and professional, and covers all the necessary details.

The big header at the top highlights your business name, and the payment terms section at the bottom is an excellent place to add your account information, payment methods, links, terms and conditions, and other details.

6. Creative Agency Invoice Template

If you’re looking for an invoice template that’s as creative as your services, this artistic, colorful invoice template is just what you need.

This template is ideal for graphic design services, branding services and other creative businesses, but you can also use it for any other purpose as long as it’s aligned with your brand identity.

7. Ecommerce Invoice Template

This ecommerce invoice template is ideal for retailers, online stores and businesses in the fashion industry.

The highlight of this invoice design is that it allows you to add images of your products to pinpoint the exact items sold.

However, if you want to use this template for any other purpose, such as for services and consulting, you can do so by customizing the template in Visme’s invoice editor.

8. Accounting Invoice Template

This invoice template is ideal for modern accounting businesses and other corporate services that want to stand out with a non-boring, professional invoice design.

Unlike traditional invoices, this template is designed with an eye-catching side bar that holds important information like invoice number, date and company details.

9. Photography Invoice Template

Create a branded invoice to bill clients for your photography services using this specialized invoice template.

This invoice template is unique and designed especially for photographers and videographers — it comes with a large image header, covers all the important details a photographer needs, and has a warm and friendly vibe.

Modify this invoice with your own details and brand colors, and share it online, send off in an email or download in high-quality PDF format with bleed marks for printing purposes.

10. Gardening Invoice Template

This green invoice template is a perfect fit for organic, food, environmental and gardening businesses with its nature-inspired design.

However, you can easily modify it with your own colors and fonts for your own business. For example, you might want to use it for your vegan restaurant.

11. Cargo Invoice Template

This invoice template is simple and professional, with a clean design made with plenty of white space that allows your content to breathe.

Because of its simplicity, this invoice template is incredibly versatile. It’s crafted for a cargo company, but can easily be customized for any other business or industry.

There’s even a space for you to add your digital signature. If you’d prefer a handwritten signature, you can delete the placeholder signature in Visme’s invoice editor, and leave the space blank before downloading and printing.

Best Practices and Mistakes to Avoid When Creating an Invoice

Here are some best practices to follow and common mistakes to avoid when creating invoices. We’ve also added expert insights to guide you.

Treat Your Invoice Like Part of Your Brand

No matter how accurate your invoice is or how prompt your delivery, sloppy presentation can cost you credibility and payment delays. Your invoice is the final touchpoint in your client’s experience and if it feels like an afterthought, that’s exactly how your client will treat it.

Instead, your invoice should reflect the same clarity, consistency and attention to detail you bring to your client work. Use clean design, plain language and a structure that reinforces your brand’s tone and values.

Write Your Payment Terms With Clarity

Even the most polished invoice can lead to late payments if your terms are unclear. Phrases like “Net 30” might sound professional, but they force clients to do mental math, or worse, ignore the deadline altogether. Vague language creates ambiguity. And ambiguity slows cash flow.

Instead, always spell out the exact due date. “Payment due: June 7, 2025” leaves no room for confusion and subtly reinforces urgency.

Add Your Customer’s Support Contact Information

One common but costly mistake is leaving out clear contact information on your invoices. When clients have questions or confusion about what they’re paying for, they need an easy way to get help—otherwise, they delay payment or avoid reaching out altogether.

As Harrison Tang, CEO of Spokeo, shares:

“One of the mistakes that we learned from invoices at Spokeo is failing to include support contact information. Early on, a few customers were confused about what they paid for and had no clear way to reach out with questions. Therefore, when designing invoices, it’s essential to include a dedicated support email, phone number, or help center link. We place it near the payment summary so that customers can easily spot it at a glance and reach out immediately if they have any questions or concerns.”

Follow Up

Following up on invoices is essential for getting paid on time, but timing and tone matter to provide results. You don’t want to come across as pushy or risk frustrating clients and damaging relationships.

Here’s what the founder of Octiv Digital, Jeff Romero, recommends:

“Allow at least 3 to 5 days before sending a follow-up communication. This technique exhibits regard for your client's schedule while avoiding appearing unduly aggressive. Once a week has elapsed since the invoice's due date, it's time to contact your customer by email and boost the urgency of your payment request. Also, show them that you actually want to help by giving them the opportunity to do so. Simply inquiring whether there is anything preventing them from making payments and if you can help them might demonstrate your desire to sustain the relationship.”

Express Your Appreciation to Customers

While invoices are transactional by nature, adding a warm, personalized note can be very thoughtful. It reminds clients that you value their patronage and can strengthen the relationship.

As Jeff puts it:

“Simply including a thoughtful, personalized statement in your bills is an easy approach to remind consumers that you value their business. You don't have to alter it every time; you may utilize a template and add a paragraph or two about how much you value their business, which can help you add a positive touch to your invoicing process.”

Design For Clarity, Not Just Looks

Poor visual hierarchy, cluttered layouts, or misaligned elements can make it harder for clients to find key information. Great design is about guiding the eye to what matters most.

Here’s what Yogesh Choudhary, CEO of Field Circle suggests:

“Make sure the most critical details, total amount, due date, invoice number, are prominent and easy to find. Use bold text and alignment, not colors, to draw attention. In terms of layout, left-align key details like client info, item descriptions, terms and right-align totals and payment info. This follows natural reading patterns and reduces confusion.”

Don’t overload the invoice with unnecessary branding elements. Your logo, color palette and consistent fonts are enough to convey professionalism. Avoid visual clutter like background patterns or too many borders.

"I also recommend adding icons or subtle visual cues like a calendar icon near the due date or a dollar icon by the total, to make your invoice easier to skim, especially on mobile, says Yogesh."

Best Tools For Creating & Sending Invoices

| Tools | Pros | Cons | Pricing | G2 Rating |

| Visme | Clean, intuitive and easy to navigate interface. Extensive range of Interactive features. Wide range of invoice templates. 24/7 customer support. Powerful AI tools to support the design process. There’s a free forever plan |

Unlocking Visme’s most advanced tools requires an upgrade to a paid plan. | Free, starts from $12.25/month | 4.5/5 |

| Zoho Invoice | Quite generous things to do with the free forever plan. Seamless integration with Zoho applications and third-party tools. |

One of the most frequently mentioned drawbacks is the poor customer support. Some users find Zoho's interface to be busy and overwhelming, especially when dealing with multiple apps within the Zoho ecosystem. |

Free, Starts from $25/month | 4.7/5 |

| Freshbooks | Intuitive and easy to use.

24/7 chatbot support. Accurate time tracking features. |

No support for custom reporting

Does not support multi-currency invoicing Not suitable for inventory-heavy industries like retail or food service |

Starts from $21/month | 4.5/5 |

| Intuit QuickBooks | Comprehensive contact records and transaction forms.

Strong inventory management and time tracking capabilities. Wide range of customizable reports. Supports project management, payroll and various add-ons. |

Some features are not available in the mobile app. | Starts at €18/month | 4.4/5 |

Visme

Best for: Businesses of all sides that need visually appealing, fully branded, or interactive invoices.

G2 Ratings: 4.5/5

Overview

If you’re looking for an invoicing tool that strikes that tricky balance between simplicity, design and robust functionality, Visme is your best bet.

It is a powerful all-in-one visual design tool with an extensive range of features for creating professionally designed invoices and other business assets.

Design isn’t my strong suit, but I found Visme’s interface to be very user-friendly. The sleek, drag-and-drop interface is incredibly intuitive even if you've never used a design tool before. And once you land on the dashboard, you’ll find a wide range of professionally designed invoice templates for different use cases such as retainer, recurring, proforma, collective, credit, debit, interim, timesheet, overdue and more.

For this review, I wanted to create a basic invoice quickly. I simply chose one of Visme’s clean, modern invoice templates, dragged it onto the canvas and added my invoice details. In less than 10 minutes, I had a professional-looking invoice.

Even if you have your invoice information in Google Sheets or Excel, you can simply copy and paste or connect your table to live data.

Just copy the URL and paste it into Visme. Then click Connect Sheet by URL or connect your chart to live data in Google Sheets or Excel. Better yet, download the spreadsheet as a CSV or XLSL file and upload it to the editor.

There’s also an option for you to connect your sheets to Excel online so any updates to the sheet reflect instantly on the invoice.

You can as well incorporate your company's branding, adjust the color scheme or modify the layout to match your brand’s identity.

One of the most impressive features is how Visme offers a wide variety of tools to make invoices more than just static documents.

Want to highlight a payment action? You can add an animated “Pay Now” button that links directly to your payment page.

You can even add subtle hover effects to certain rows for extra polish and use pop-ups to clarify charges or payment terms. These small touches add a layer of professionalism and interactivity you rarely see in basic invoices.

If you’re working on multiple invoices, you could use the dynamic fields (variables) to auto-generate multiple versions of your invoice with updated client names, amounts, or services.

And here’s the icing on the cake: Visme allows you to integrate with your HubSpot or Salesforce account so you can easily share and collaborate on your documents. This integration empowers your sales team to streamline their deal-making and invoice processing, no matter which CRM or sales automation tool they prefer to use.

Once your invoice is ready, sharing is effortless. You can download it as a PDF or generate a secure, online shareable link to send to your client or team, whether for domestic or international payments. When you share your invoice as a link, you can easily track if your client has viewed your invoice and know when to send a reminder.

Pricing

- Basic: Free

- Starter: $12.25/month

- Pro: $24.75/month

- Visme for Teams: Request for pricing

Note: Visme offers discounted pricing plans for students, educators and nonprofits.

Zoho

Best for: Business owners who want tools for project billing and expense management built into their invoicing workflow.

G2 Rating: 4.7/5

Overview

Next up is Zoho Invoice, a robust platform that’s great for managing billing, payments and client communications in one place. Zoho Invoice is just one of 40+ cloud software apps of the Zoho ecosystem.

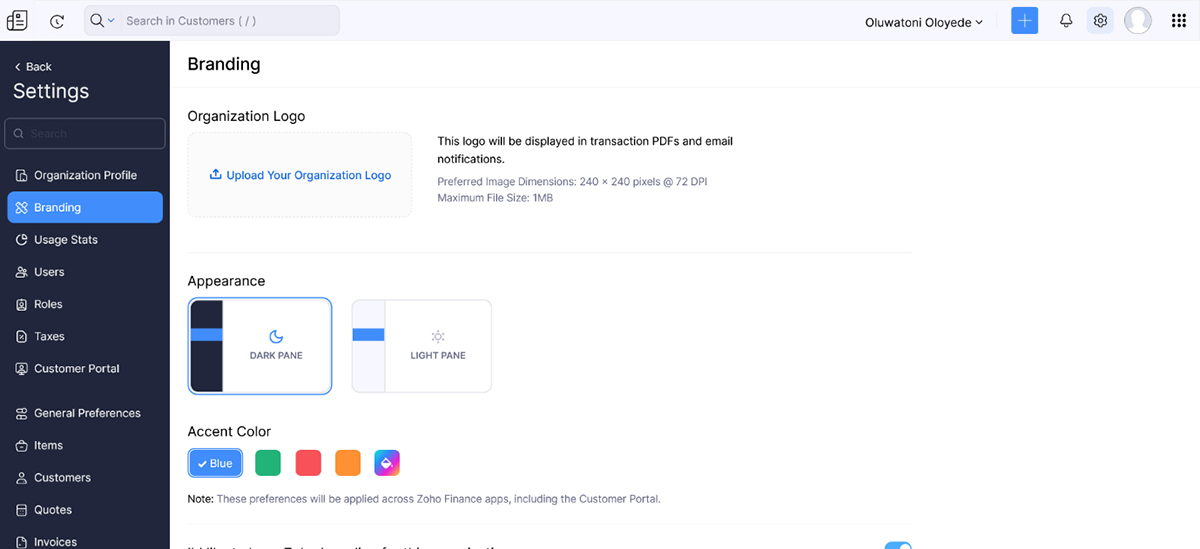

After signing up, I first explored the Settings via the gear icon and found features that caught my attention.

You can add users with custom access levels, select supported currencies, set up branding, enable time tracking for billable hours, automate reminders and configure recurring invoices or multi-level approval workflows. The range of options here is extensive and quite impressive.

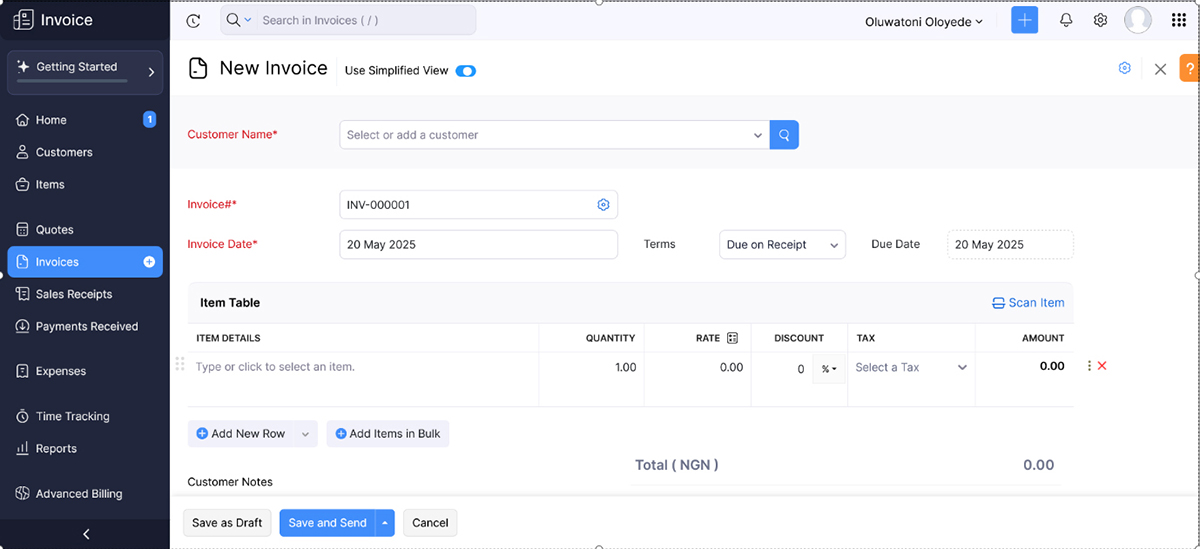

To test it out, I created a new invoice.

Clicking the invoice icon brought me to a customizable template. I selected a customer from a drop-down menu, added products and services with rates and totals. You can also add custom fields or toggle on options like partial payments, attach files and even set it as a recurring invoice.

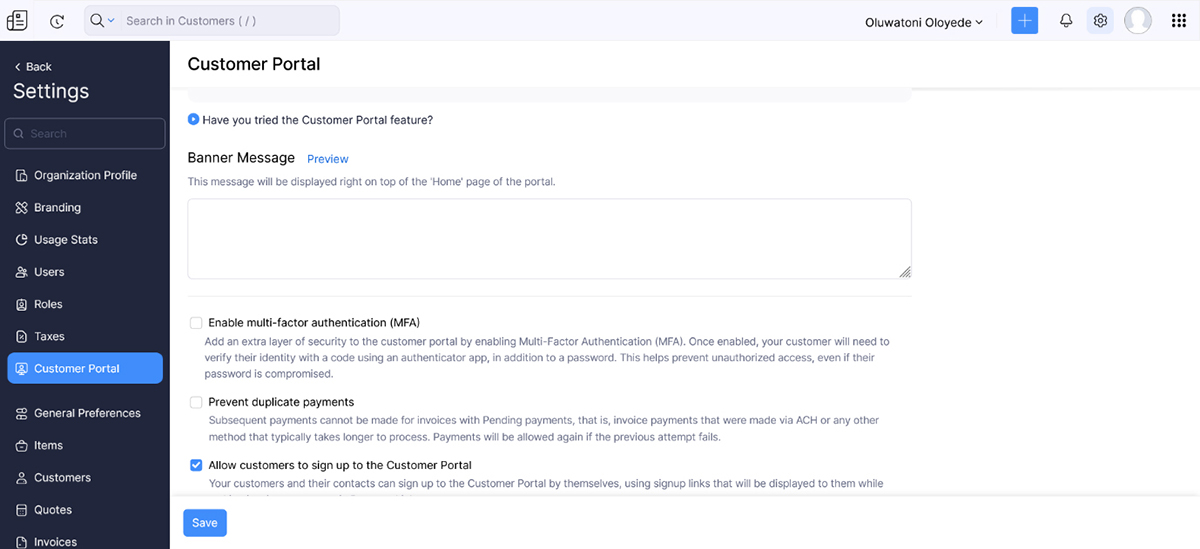

An interesting feature is Zoho’s Customer Portal, from which clients can view, comment on and approve estimates or quotes you send them.

Clients can also pay invoices directly through the portal using integrated payment gateways. Plus, the portal reveals outstanding receivables, unused credits, payment terms and a visual summary of income and expenses over the past 6–12 months.

On the analytics side, Zoho allows you to see when your client has viewed your invoice, so you can be confident it’s been received. Zoho’s integration with Zoho Analytics also gives users a live snapshot of financial performance through a clean, intuitive dashboard. You can easily track cash flow, invoice statuses, project budgets and other key financial data in real time.

Overall, I think Zoho Invoice is one of the most powerful invoicing platforms, especially if you’re already within the Zoho ecosystem and want a tailored, professional invoicing experience.

Pricing

- Standard: $25/month

- Premium: $59/month

- Custom

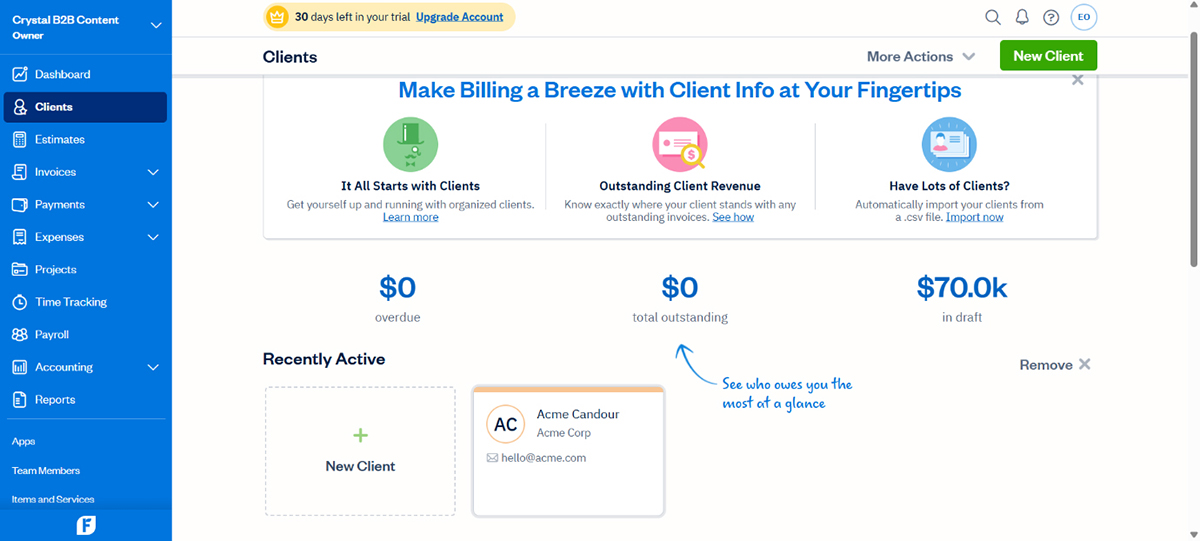

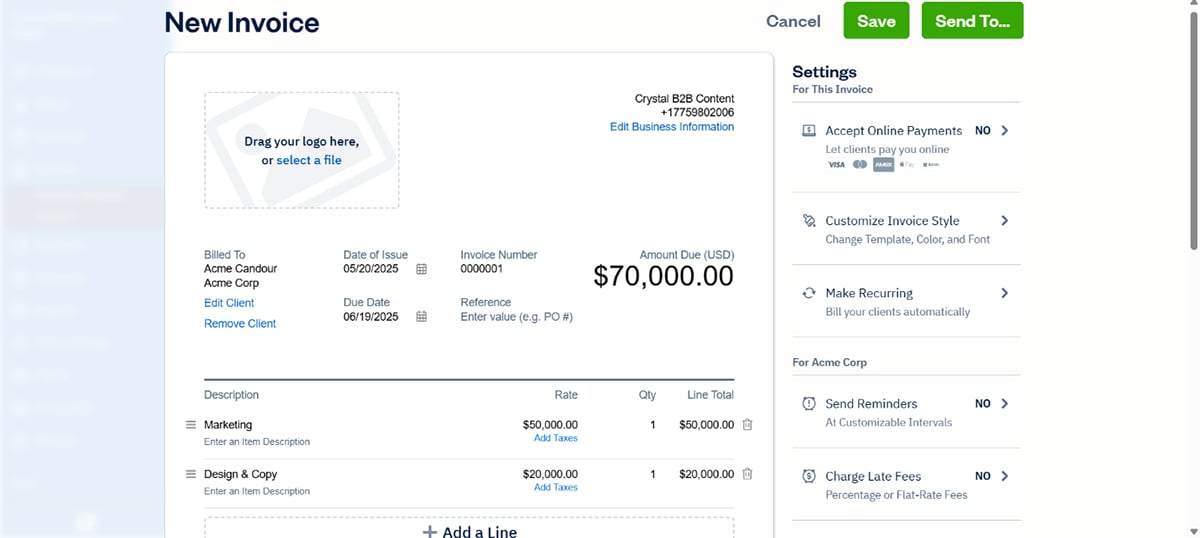

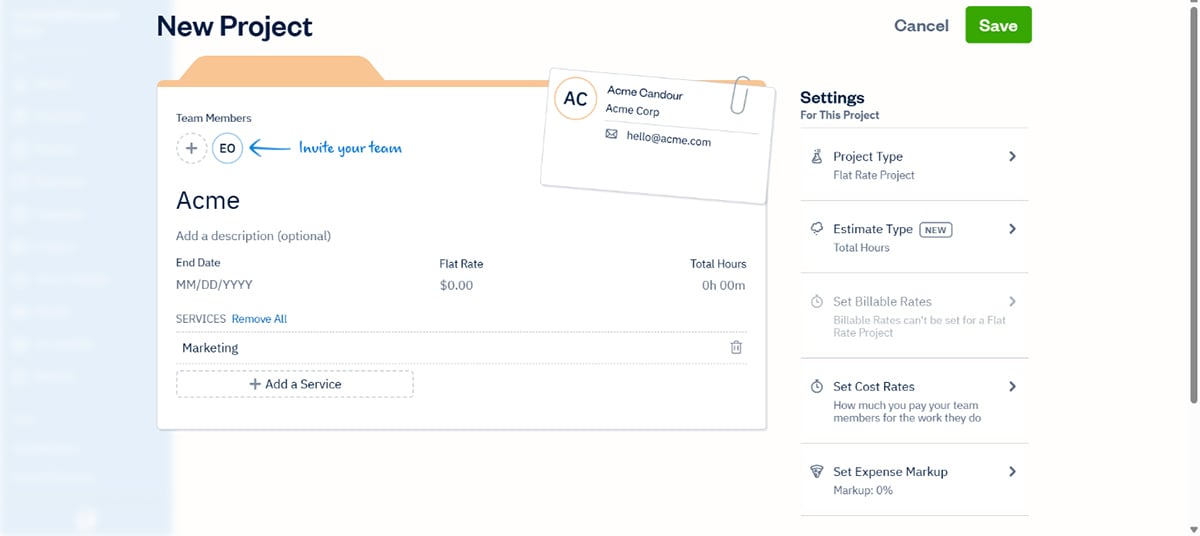

FreshBooks

Best for: Service-based business owners looking for invoicing solutions and accounting tools.

G2 Rating: 4.5/5

Overview

FreshBooks is another invoicing tool built specifically for service-based professionals and small businesses

Like Zoho Invoice, FreshBooks also offers customer portals. Once you upload a CSV or enter a customer’s details manually, FreshBooks creates a dedicated space that tracks all transactions with them, complete with a visual chart of outstanding revenue.

FreshBooks also lets you convert existing estimates or proposals into invoices, which are handy if you’re juggling multiple project stages. You can set up payment reminders and track whether your client has viewed the invoice.

I created a test invoice for a web design service. The tool provided a template, and I was able to easily customize it with my invoice details.

While customization is more limited than tools like QuickBooks, FreshBooks makes up for it with strong project integration. You can assign invoices to specific projects, track budget progress and view any unbilled time or expenses. The platform even calculates project profitability in real-time.

FreshBooks might be a great fit if you’re focused on services and want a tool that blends time tracking, client management and invoicing into one easy flow. Just keep in mind the customization and reporting features aren’t as deep as some alternatives.

Pricing

- Lite: $21/month

- Plus: $38/month

- Premium: $65/month

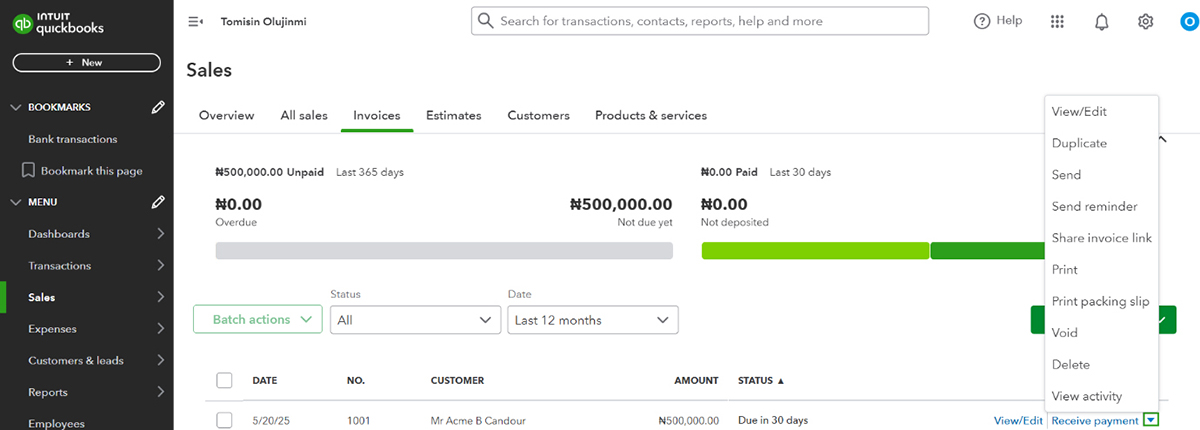

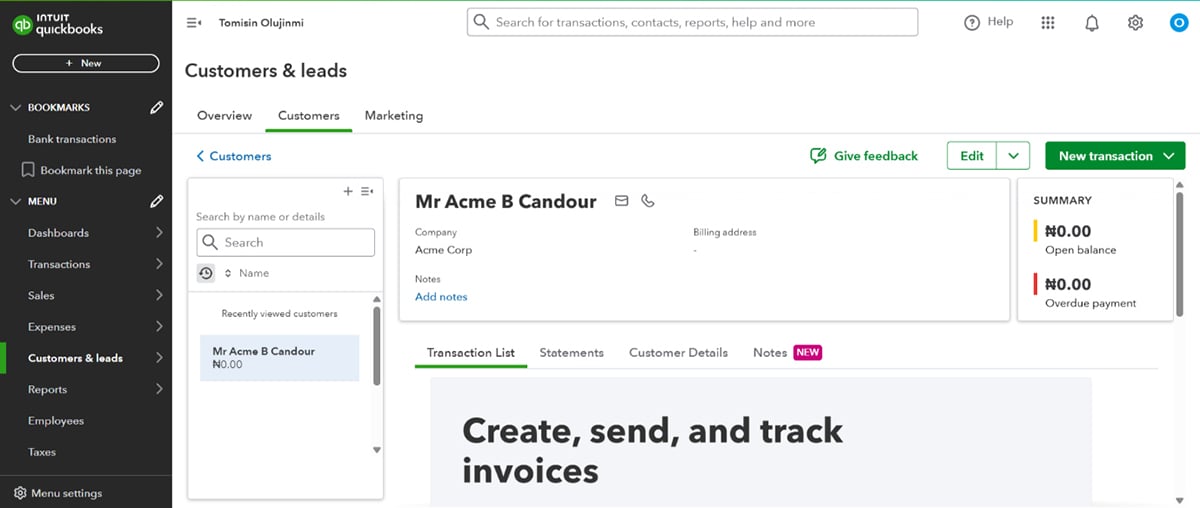

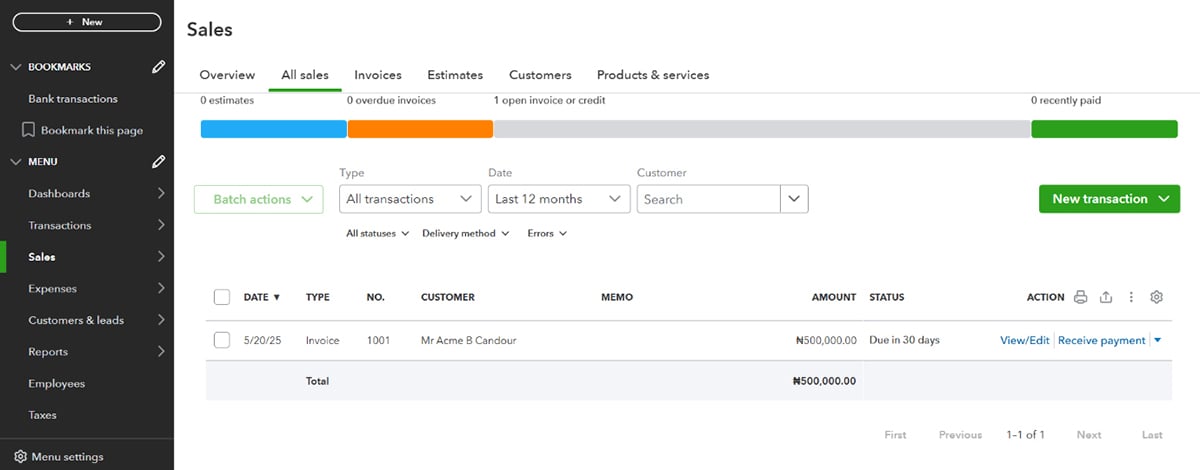

Intuit QuickBooks

Best for: Small to mid-sized businesses that need both invoicing and full-featured accounting tools in one platform.

G2 Rating: 4.4/5

Overview

If you’re looking for a full-featured, professional invoicing experience tied to powerful accounting features, Intuit QuickBooks absolutely earns its place at the top.

Everything in QuickBooks feels intuitive right out of the box, yet it also offers customizable menus so you can tailor the interface to your workflow.

Although the tool has a steeper learning curve compared to other options on this list, the company provides tutorials and support articles to help users get up to speed.

A little drawback I spotted is that essential features are tucked away behind the “More” or “All” button, which might feel less intuitive, especially for first-time users.

One area where QuickBooks truly shines is in its detailed customer records. The tool also supports multiple import formats, including CSV, Excel, Google Sheets and QuickBooks Desktop.

Each customer profile includes not only contact information but also uncommon fields like preferred language and Price Rules, which is a handy feature for setting conditional pricing.

Plus, every customer page offers quick access to related transactions, statements, projects, recurring billing and late fees.

QuickBooks also offers stellar reporting tools, far beyond basic invoice tracking. You get detailed reports on sales, customer balances, A/R aging and even accountant-grade documents like cash flow statements and balance sheets. This kind of insight is invaluable when you’re scaling or managing multiple clients and income streams.

Pricing

- Simple start: €18/month

- Essentials: €26/month

- Plus: €37/month

- Advanced: €70/month

FAQs About Invoice

Yes, Google Docs does offer invoice templates, though they are quite limited compared to dedicated invoicing tools or platforms like Visme.

No. Making an invoice can be quite simple, especially with the right tools.

Invoices are typically issued after goods or services have been provided, but the exact timing can vary depending on the type of business, agreement with the client, or industry standards.

Yes, it is okay to send an invoice by email.

The time it takes to process an invoice can vary depending on the organization, payment terms and approval workflow.

Whether you need to add VAT (Value Added Tax) to your invoice depends on two major factors

If you’re VAT-registered, then you should include it on your invoice. However, if you’re not VAT-registered, you cannot charge VAT.

Whether you need to add VAT (Value Added Tax) to your invoice depends on two major factors:

VAT registration status:

If you’re VAT-registered, then you should include it on your invoice. However, if you’re not VAT-registered, you cannot charge VAT.

Client location:

- If your client is in your country (domestic), VAT usually applies.

- Within your region, rules vary; sometimes VAT is reverse-charged.

- Outside your country or region (e.g., international sales), VAT may not apply, but you must state why it’s zero-rated or exempt.

Looking for a Free Invoice Generator?

A well-crafted invoice not only ensures you get paid on time but also reflects your professionalism and attention to detail.

With Visme, creating clear, polished invoices is seamless, even if you’re not a designer. Our intuitive platform offers a full suite of visual tools, along with professionally designed invoice templates, to help you build custom, branded invoices that make a lasting impression.

Beyond invoices, Visme allows you to design a wide range of business documents, including manuals, checklists, ebooks, presentations, proposals, infographics, recruitment videos, employee handbooks, interactive decision trees and more.

Ready to take your invoicing process to the next level? Sign up and start using Visme’s invoice maker today.

Create Stunning Content!

Design visual brand experiences for your business whether you are a seasoned designer or a total novice.

Try Visme for free